Where are New Boat Prices Going for 2023?

In the two-year period from 2019 to 2021 boat prices jumped 20% overall with inboard cruisers, the largest boat category, increasing 32.8% for the period. On average, boat prices increased another 10% in 2022, so the question begs, where are boat prices going this year? Will lower inflation and lower oil prices also lower boat prices from their 2022 high?

Many elements that make up boat prices seem to indicate a moderation in the underlying factors that make up the price of new boats. The high boat demand caused by the pandemic has subsided. Oil prices are down from their high, and supply chain issues are no longer as prevalent. The stock market is down 20% from its high, and most major banks are saying a recession is likely in the second half of 2023 – so should new boat buyers keep their powder dry – or, pull the trigger now?

Let’s look at some of the underlying factors affecting boat prices to see if they give us some guidance:

- The COVID-19 induced pent-up demand for boats that exceeded supply seems to have peaked in 2021 in general, and overall new boat sales were down from that level in 2022 in all categories except sailboats. Overall, boat sales were down 14% in 2022, indicating a trend to pre-covid levels of boat sales. Now, the effect of Covid seems to be more about what will be happening in China now that restrictions have been taken off. This is a developing story.

Supply chain issues in the aftermath, and still ongoing in some countries, of the Covid-19 pandemic has caused hold ups in the global supply chain. - Supply-chain issues that increased costs due to alternate workarounds and supply/demand dynamics have moderated. The cost of shipping that spiked during 2020-21 has been reduced significantly. The drop in new boat sales that occurred last year has taken the pressure off of parts such as windshields, electronics and the like. That should mean that the price of many components will now stabilize – the effect of Covid in China notwithstanding.

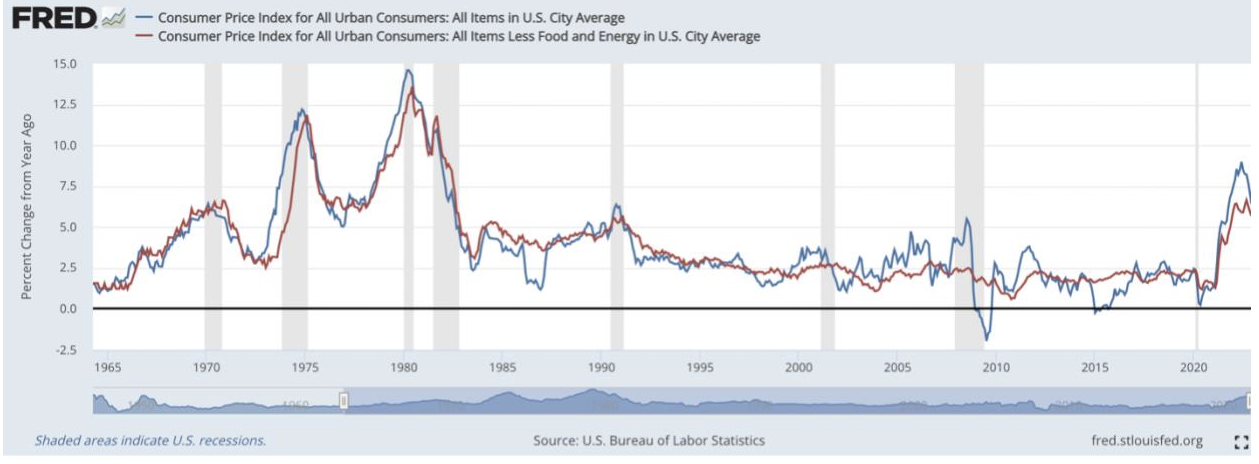

The chart above shows the annualized inflation rate for the last 57 years, with the blue line indicating the overall rate, and the red one represents inflation without food and energy. - Inflation, while it may have moderated last month, nevertheless caused builders to crank in a 5-10% rate increase when they had to make pricing decisions in the summer of 2022. Price increases were lowest in the small boats with easily sourced materials and stiff competition.

- Putin’s War which caused oil prices and basic food staples to spike in 2022, currently seems to be moderating, but could bust out again at anytime. Don’t discount the effect that the war is having on Poland’s labor market. No fewer than 10 brands now sold in the U.S. are built there. Roughly 30% of Poland’s boat builders’ shop floor personnel were Ukrainians who have now largely gone to fight for their country.

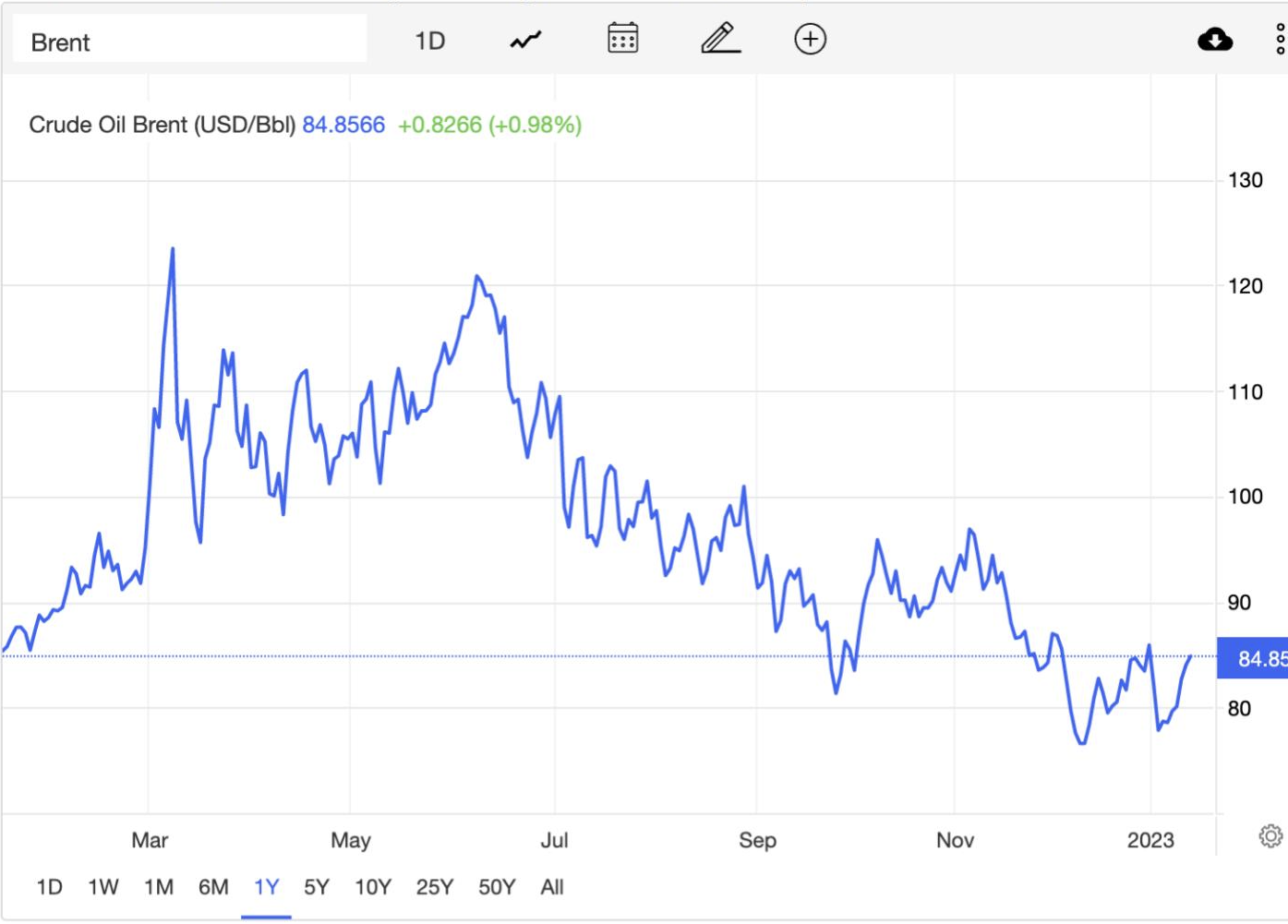

This chart shows the cost of Brent light crude oil in dollars per barrel. To be read: on Jan. 13, at 12 noon, Brent crude oil was selling for $84.85 PPB, down 17% from its November high of $102. - Oil prices seem to be moderating which will take the pressure off the cost of resin and fiberglass, and general transportation costs. Resin and fiberglass are virtually the only “commodities” used in boat building and there is basically a world price for them, just as there is for oil. Since a significant portion of the weight of a boat is composed of resin and fiberglass, oil dropping from $102 PPB to $85 PPB will eventually lower the cost of these materials, and could take some pressure off the builders on pricing. Nevertheless, oil pricing is a sword of Damocles always hanging of the heads of boat builders in these turbulent times.

- A recession has been widely predicted for the fall of 2023, but even in the aftermath of the Great Recession, new boat prices only stepped back one year as stock was liquidated. So, if there is a recession, we don’t see that has having much an effect on new boat prices – at wholesale. Price reductions, if any, will come at retail as sales melt away and dealers need to raise cash. But keep in mind that margins are relatively thin on some popular brands, and on most small boats. In some large brands, some builders may help with a special discount on the wholesale price. Each size and type boat, and each brand will have its own story.

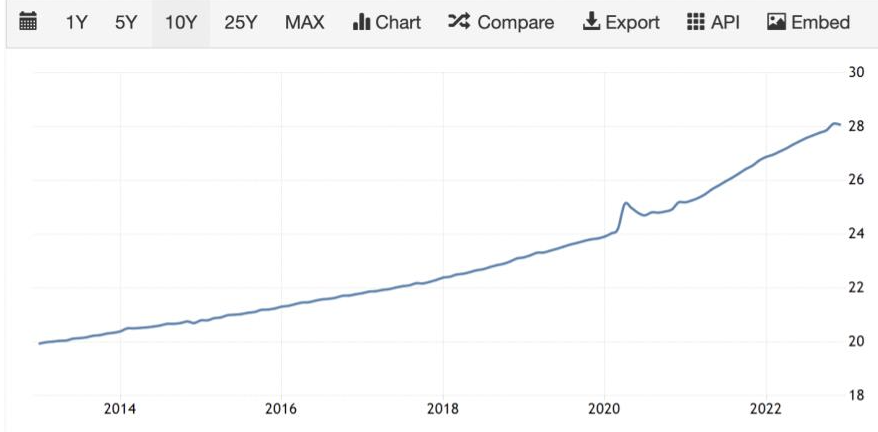

This chart shows the rise in the average hourly labor rate paid in the U.S. Note the degree of increase was raised after the Covid bump. To be read: the average hourly rate in the U.S. is $28. - Wages for shop floor personnel will continue to rise, if history is an indicator. Virtually all boat companies are begging for more help, and we see no end in sight, even with a mild recession. Hourly rates are going up at a faster clip, a result of both a post-pandemic work-ethic shift and inflation. Wages are not going down in the boat industry, and it is a labor-intensive business.

Adding to the scarcity of outboard engines are the number of boats that have triple and quad outboard engines these days, a sharp increase from years past. - Outboard engine availability continues to be tight over 300-hp but lead times for boats in this class has meant that there has been time for builders and dealers to find sources of power. Also, sales of boats in this category has dropped, releasing pressure on supply. The average price for engines for the 35,000 300-hp and over outboard engines sold was $25,600 in 2021, up 8% from 2019.

- Supply and demand has a limited effect on new boat prices other than in the short term with “mass-market” brands. Boats are not commodities like gasoline, grapes and wheat. Even the most basic ones are largely hand-built, and boat company overhead was long ago reduced to bare essentials in terms of assets and personnel at most companies.

Intel breaks ground on a new $20 billion plant in Chandler, AZ. New, government-subsidized chip making will soon begin in Ohio. - The Cost of Turning Inward: Because of supply disruptions, U.S. tariffs and political and Covid troubles in China, there is a new trend for American businesses to look for alternative countries for sourcing. This will inevitably mean higher prices for components.

Should You Buy Now or Wait?

Boats are not a commodity. They are all hand-made and complex. Further, there is a minimum basic infrastructure that must be in place to support the manufacture of boats and this fixed cost must be borne by the units produced. The fewer boats built, the higher the fixed cost allocation is per boat.

Further, new technologies come along every year to make boats even more utilitarian, more fun and trouble-free than ever before. These enhancements are always added to the boats’ cost.

Moreover, the consolidation that has taken place over the last 20-30 years in the boat business has resulted in fewer brands and fewer companies building them. The same goes for their equipment suppliers, where there has been a consolidation frenzy over the last five years. That means competitive pressures are far less than there were before.

The Bottom Line

There were nearly 14 million new automobiles sold in the U.S. last year compared to just 218,000 new boats. When car sales hit a stone wall, companies often drop prices significantly because there are hundreds of thousands of units in inventory. And, people need cars.

The boat business is different. When sales stop – it is full stop, because no one needs a boat. Builders furlough staff and hibernate, and try to wait out the downturn as long as they have positive credit line – or no debt.

No Debt No Problem

We have been in the factory of a major builder during a severe recession who had no debt. There were just two watchmen employed, the boats sat under wraps, and when the economic trouble blew over, the boats were sold at only a small discount because they were non-current, otherwise absolutely new.

Some dealers also own the boats they are selling and have no floor planning debt. Those dealers usually wait out the recession in Costa Rica fishing.

The opposite extreme are companies that have massive debt – they are in trouble and will likely go out of business leaving buyers of fire-sale-priced boats with a worthless warranty. Then, there are the rest of builders, most of which have made provisions for a rainy day. Likewise, most dealers protect themselves by having a small inventory.

Our advice is always the same in these times: What is the loss of a season or two of boating worth to you and your family? How many seasons do you have left? After all, boating is not an exercise in saving money.