Light at the End of the Economic Tunnel?

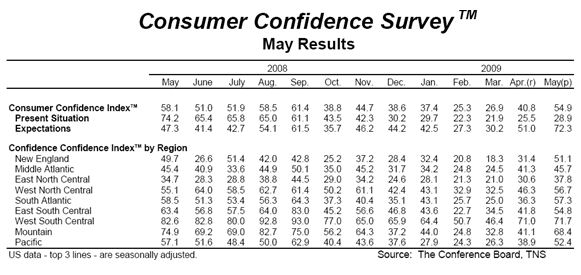

The Conference Board Consumer Confidence Index™, which had improved considerably in April, posted another large

gain in May. The Index now stands at 54.9 (1985=100), up from 40.8 in April. The

Present Situation Index increased to 28.9 from 25.5 last month. The Expectations

Index rose to 72.3 from 51.0 in April. The Consumer Confidence Survey™ is based

on a representative sample of 5,000 U.S. households. The Index is now at its highest

level since September, 2008 when the collapse of Lehman Bros. nearly caused a world

economic meltdown. Confidence is stronger in some parts of the country than others.

The monthly survey is conducted for The Conference Board by TNS. TNS is the world’s

largest custom research company. The cutoff date for May’s preliminary results was

May 19th.

Says Lynn Franco, Director of The Conference Board Consumer Research Center: “After

two months of significant improvements, the Consumer Confidence Index is now at

its highest level in eight months (Sept. 2008, 61.4). Continued gains in the Present

Situation Index indicate that current conditions have moderately improved, and growth

in the second quarter is likely to be less negative than in the first.

More Optimism

Looking ahead, consumers are considerably less pessimistic than they were earlier

this year, and expectations are that business conditions, the labor market and incomes

will improve in the coming months. While confidence is still weak by historical

standards, as far as consumers are concerned, the worst is now behind us.”

Consumers’ overall assessment of current-day conditions improved again. Those claiming

business conditions are “good” increased to 8.7 percent from 7.9 percent. However,

those claiming conditions are “bad” increased to 45.3 percent from 44.9 percent.

Consumers’ appraisal of the job market was also more favorable. Those claiming jobs

are “hard to get” decreased to 44.7 percent from 46.6 percent in April. Those saying

jobs are “plentiful” edged up to 5.7 percent from 4.9 percent.

Rising Expectations

Consumers’ short-term outlook improved significantly in May. Those expecting business

conditions will improve over the next six months increased to 23.1 percent from

15.7 percent, while those anticipating conditions will worsen declined to 17.8 percent

from 24.4 percent in April.

The employment outlook was also less pessimistic. The percentage of consumers expecting

more jobs in the months ahead increased to 20.0 percent from 14.2 percent, while

those anticipating fewer jobs decreased to 25.2 percent from 32.5 percent. The proportion

of consumers anticipating an increase in their incomes edged up to 10.2 percent

from 8.3 percent.

|