Boat Market Report - March 4, 2023

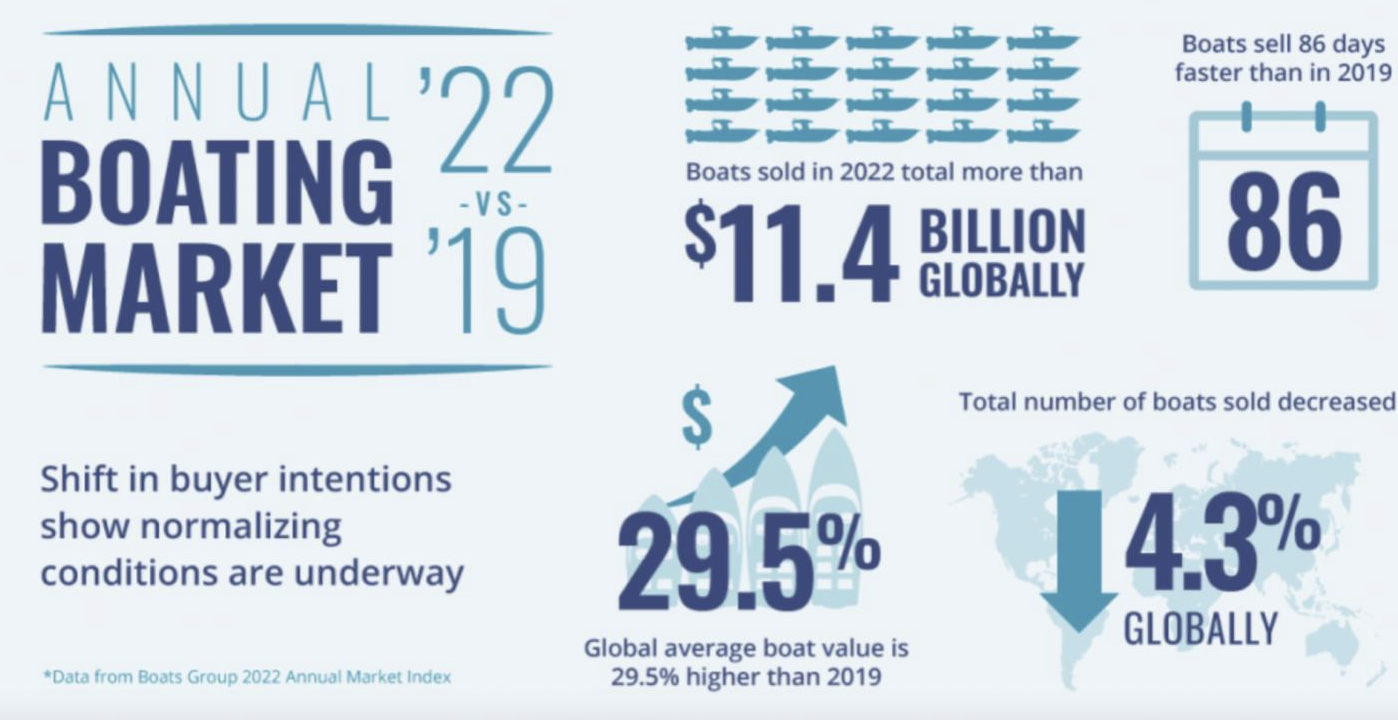

The boating market began to normalize last year as buyer interest shifted and the total number of boats sold globally decreased for the first time since the pandemic-driven boom. Boats Group, owner of Yacht World classified listings and others, analyzed 2022 sales and prices of used boats compared to 2019.

The change towards more typical market conditions emerged in 2022 as the total number of boats sold dipped by just 4.3% compared to the same period in pre-pandemic 2019. By comparison, boats sold in 2020 and 2021 were down 15.9% and 11.8%, respectively, compared to 2019.

Additional factors of increased boat value, lack of inventory and softening consumer demand also impacted market fluctuation. In December, a significant shift in the total volume of U.S.-based Google searches by online boat shoppers fell behind the same period in 2019, illustrating the cooling of buyer demand.

- The number of boats sold down 4.3% compared to 2019

- Online buyer interest shifts for the first time in three years

- The global average boat value is up 29.5% compared to 2019

- Boats sold in 2022 total over $11.4 billion globally

- Rising interest rates drove smaller loan amounts

“For the first time in three years, we’re seeing consumer demand soften, said Courtney Chalmers, vice president of marketing at Boats Group. “The effects of the demand and supply chain disruption during the pandemic are also still very apparent. Boats continue to move off the market faster and sales remain higher than before the surge.”

The overall value of vessels dropped below 2021 by roughly 16%, inching closer to values seen in 2020. However, 2022 total values remained higher than before the pandemic boating boom, totaling more than $11 billion in sales.

The global average boat price was 29.5% higher than in 2019 and was comparable to 2021. According to Trident Funding, a leading marine lending company, boat loan applications were up by 80% in 2022 compared to 2021. Trident reports loan amounts were smaller than in 2021, primarily driven by rising interest rates.

“Borrowers are feeling the elevated boat prices and rate increases, yet are looking to continue their adventures on the water, just in a more affordable way,” said Mark Breeden, president of Trident Funding.

“The substantial rise of applicants last year shows boaters’ dedication to their lifestyle and is encouraging for the industry as we transition from the boating boom that occurred during the pandemic. As the supply chain and inventory levels normalize, we look for the market to provide increased ways for consumers to enjoy their time on the water.”

Inventory levels also made a significant comeback last year, as listings were a mere 4.5 percent below 2019, driven by new boats coming to market. This considerable growth is yet another signal that the industry is nearing more balanced supply and demand conditions.