Boat Prices are Low But Sales are Slow

Automobile Prices are Rising

When will Boat Prices Begin to Do the Same?

There is an interesting phenomenon going on in the marketplace today: car buyers are racing to buy both imported and U.S. brands before the higher-tariffed imported cars and the offshore components in domestic vehicles hit dealer showrooms -- but boat buyers are not! Both U.S. brands and imported brands remain over-inventoried for many brands and sizes of boats.

According to Baird Research, U.S boat dealers were over-inventoried by 60% in April, 2025, the last month for which we have data.

Retail new boat sales were down 40% in April across the boat, on average, according to the same report. Still worse, according to Baird Research overall boat dealer sentiment for current sales outlook, and the outlook for the next 3 to 5 years is lowest it has been, since January, 2014, when the company began polling dealer sentiment.

Even sales of used boats are way down, which speaks to a broader macro-problem much bigger than the boat business. In total, the boat business was a $55 billion industry in 2023, according to the NMMA. To put that in perspective, the auto parts retail sector—covering chains like AutoZone, O’Reilly Auto Parts, and NAPA—posts a combined annual revenue around $55–60 B, comparable to marine sales (Estimates based on public filings).

The latest NMMA data we have is from March, and it shows an 8.4% decline in rolling 12-month year-over-year retail sales. The steepest declines in retail sales for the 12-month rolling period were —

| Pontoon Boats | -21.1% |

| Jet Boats | -17.3% |

| Wake Boats | -16.0% |

| Cruisers | -14.2% |

| Saltwater Fishing Boats | -11.6% |

It is in these types of boats where dealers are most likely to be over-inventoried, and where consumers on the hunt should look.

Pre-Liberation Day Sales Numbers

President Trump announced his new tariffs on April 2, 2025. They were set to take effect on April 9th for 57 countries, but Trump put them on “pause” until July 9, 2025. During April and May, we saw on-again, off-again tariffs for different countries, but as of now, it seems that the base rate of 10% holds for most of the world, with 30%+ (more like 54% in total) for China. Last week, President Trump announced that he would extend the pause into he fall.

Here were retail sales, by units, for the month of March, by boat type, as reported by the NMMA (National Marine Manufacturers Association) —

| Aluminum Fishing Boats | 6,926 |

| PWC | 5,865 |

| Pontoon Boat | 4,149 |

| Saltwater Fishing Boat | 1,146 |

| Runabout | 564 |

| Wake Boat | 790 |

| Cruiser | 597 |

| Jet Boat | 751 |

| Yacht | 204 |

Buy Low, Sell High, or Hold

There aren't many times when you can buy a boat today and see its Blue Book worth almost the same amount the following year – but could be happening with imported boats in inventory today, being sold at pre-tariff prices. Domestic brands will also likely see price increases, but obviously, they will be most noticeable with imported boats.

Many U.S. dealers are offering deep discounts on many boats, foreign and domestic, and all of that will likely change when these boats are all sold. U.S.-made boats will see price increases due to tariffs for items such as imported engines, electronics, and equipment such as windlasses, some generators, ground tackle, general hardware, some electrical equipment, and other items. The magnitude of these increases is unknown at this point. But the direction will be up.

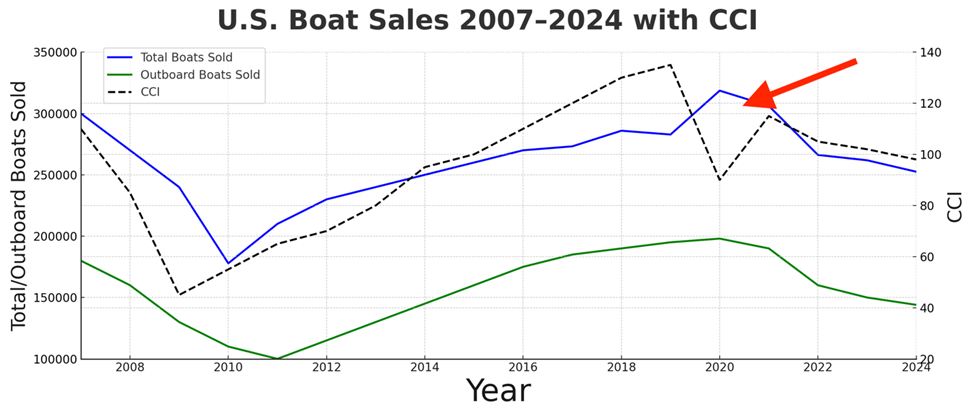

For most people, it's difficult to buy a stock when its price is down for fear it will go lower. But for investors who can measure where price support lies, buying low is the name of the game. The same is true for buying new boats: buy them when there are deep discounts and consumer sentiment is low. Sell them when consumer sentiment is high and desirable models are in short supply. And just as with stocks, buy quality because dollar-for-dollar, you'll get a greater percentage of your investment back.

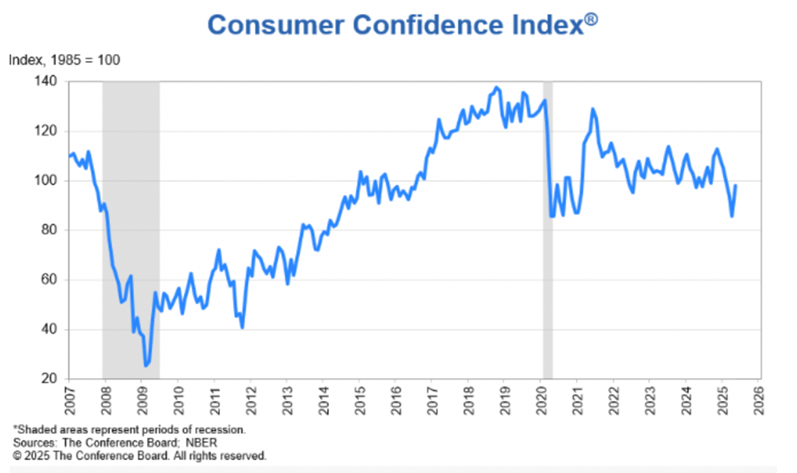

In the chart above, the good news is that the Consumer Confidence Index (CCI) went up 12.3% to 98.0 in May, which analysts attribute to the lowering of tariffs on goods coming out of China to 30%. The bad news for the boating industry is that the CCI is bouncing along at the levels seen in January, 2020 – before the COVID-induced boat-buying frenzy started.

The above chart shows overall boat sales (blue line), and the arrow points to the COVID-19 boat-buying phenomenon – the only time boat sales bounced higher when the CSI dropped lower. A once-in-a-lifetime event for boat salespeople. As can be seen in the chart, both consumer confidence and boat sales are marching in lockstep on a downward trajectory.

There is a message here for boaters looking for a good buying opportunity.

Some questions beg for answers...such is how the boat industry got into this over-inventoried position, and how is the auto industry coping with the looming tariffs? Stay tuned.