The Day the U.S. Cruiser Industry was Murdered

On November 5, 1990, the U.S. Congress took careful aim at the boating industry with a 10% luxury tax on new boats costing more than $100k and fired. Before the law was repealed more than two and a half years later, no fewer than eight major builders had gone out of business. The rest were on life support. By 1999, at least six more had thrown in the towel. The whole category of the business was so weakened that in the years to follow, at least nine more builders of large boats died a merciful death.

In August of 1993, the tax was rescinded. Then, just three months later on Nov. 1, 1993, the European Union went into effect. Fifteen nations came together to form one large market with one currency so their industries could rival those in America. It worked in the boating industry, largely due to the duplicity power of one man.

America’s Powerboat Heyday

It’s hard to imagine it now, but from the end of WWII to the early 1990s American boatbuilders dominated the powerboat industry worldwide.

American boats were the best built, the most technically advanced and the most sought-after all over the world. Foreign boatyards with relatively small national markets could not compete with the United States and its huge, wealthy market.

A Political Applause Line

In a nutshell, Congressman Dan Rostenkowski, chairman of the House Way and Means Committee – the most powerful man in Washington, DC at the time – spearheaded the 10% luxury tax on boats. In the summer and fall of 1990, the National Marine Manufacturers Association (NMMA) organized its members to descend on Washington to lobby their congressmen against the bill.

Boating magazines, boatbuilders, Boat/US, boat clubs, dealers, owners and even newspaper columnists railed against the proposed tax to no effect. Dan Rostenkowski’s mind was made up. His defense was that congress didn’t consider job loss when raising taxes as they had done on tobacco and alcohol. (Neglecting to mention that tobacco farmers were subsidized for years.)

Rostenkowski had no boatbuilders, dealers or marine industry companies in his district. His voters wouldn’t be directly affected. And, he won re-election 79.1% to 20.9%. Overall, the Democrats won big that year, picking up seven House seats and one Senate seat.

Soak the Rich

The 10% luxury tax was a “soak the rich” rallying cry for Democrats running for congress all across the country even before the law was passed. “Rosty” rushed the law through without having a hearing on the matter, passing the act just one day before the Nov. 6, 1990 elections. The Democrats picked up seven House seats.

The Boating Industry Struck by Lightning

The new tax took effect on new boats on Jan. 1, 1991. The effect was to immediately stop about 80% of sales of new boats in the U.S. costing more than $100,000 in just the first quarter of 1991, according to some reports. By June of that year, the Chicago Tribune reported that 19,000 jobs had already been lost in the boating industry.

GAO Report After One Year

In February of 1992, a report by the US General Accounting Office (GAO) found that the luxury tax had collected $168 million. Most of these revenues were raised on car sales ($151.5 million) with only $7.3 million realized from sales of boats.

By the summer of 1993 – 2-1/2 years after the tax went into effect – more than 50,000 jobs had been lost, according to NMMA spokesman Greg Proteau. This number included not only boatbuilder personnel, but also people laid off at dealerships, marinas, trucking companies, boatyards plus equipment and raw material suppliers all across the country.

On July 16, 1993, the Washington Post reported that the tax on boats had raised $12,655,000 for the U.S. Treasury, or, according to the Post, “...enough to run the Department of Agriculture for a little over two hours.”

The Cost of Unintended Consequences

In the wake of the tax, many boatbuilders and boat dealers went bankrupt. Boatbuilders held on as long as they could but soon began filing Chapter 11 bankruptcies. The ones with the highest debt were the first to go under.

Other companies that had little debt but had signed “re-po” agreements with financial institutions guaranteeing that they would buy back boats from defaulting dealers were the next to be hit. They succumbed one at a time. Small builders just shuttered their doors, most never to again open.

Small Boats Hurt, Too. It is difficult to calculate the systemic damage that the tax had to the boating sales infrastructure and distribution system. Dealer margins on small boats have always been slim, which is why most dealers tried to carry a range of boats from outboards and runabouts to cruisers. The robust margin on big boats helped subsidize the whole dealer operation. It was a symbiotic system that moved people up the scale as they became more affluent and experienced.

Dealers all over the country went out of business. When they did, their small boat business stopped, too.

European Sales Save Some Boatbuilders

With American sales dried up, the only place U.S. builders could sell boats was in Europe and some extent in Oceania. The trouble was the American brands needed to have their European dealers in place before the tax. Those that did, such as Cruisers Yachts, Regal, Hatteras, Sea Ray and some others survived. Even though sales were a fraction of what they were before the tax, they were enough to service debt and keep a small staff together.

Balance of Trade Changes

Before the 10% luxury tax, the U.S. boating industry was one of the few in America that had a favorable balance of trade. It was a positive $600 million before the luxury tax. Because of the large U.S. market, American builders had the advantage of scale and could spread fixed costs over many units. The result was that American-built boats were generally better and less expensive than European-built boats.

By 1997 the export/import balance was (negative $145.6 million), on its way to – (negative $1.4 billion) in 2020.

The Demise of the Cruising Boat in America

In good years through the late 1980s, the industry would sell about 10,000 new boats for more than $100,000 per year, mostly inboard cruisers. That dropped to about 3,000 in 1991. After repeal, inboard cruiser sales came back somewhat. By 1997, 6,300 units were sold, but now many of those were built overseas.

With lower units, American builders’ fixed costs would have to be spread over fewer units, making U.S. boats non-competitive with foreign vessels with higher unit sales. Throughout the first two decades of the new century, inboard cruiser sales steadily fell until reaching just 1,700 in 2020, the vast majority being imported.

RIP – In Memoria – The Fallen

Irwin Yachts – 1991

Atlantic Yachts – Early ‘90s

Penn Yann – 1991

Jersey Yachts – 1992

Trojan Yachts – 1992

Topaz – 1992

Bertram – 1993

Morgan Yachts – 1993

Pacemaker – 1994

Phoenix – 1994

Blackfin – 1997

Egg Harbor – 1997

Albin – 2008

Luhrs – 2008

Post – 2011

Silverton – 2012

Mainship – 2012

Hunter – 2012

Carver – 2021

The above list is by no means complete, but it gives one an idea of the carnage. It may seem like many of these names survived another 10 or 20 years, but for most of them, it was surviving on a shoestring. Other names sort of melted away with no clear date of death. Nor does this list mention the builders that were sold, and stayed in business, in a scaled down manner.

The Survivors

By and large, the companies that were able to survive to this day — through the 10% luxury tax and the Great Recession — were the ones personally owned by a family of dedicated boatbuilders, had little to no debt or were owned by the Brunswick Corp.

30 Years Later

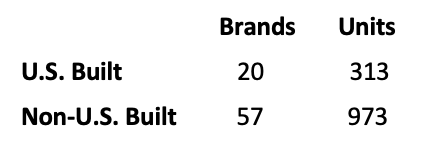

Sales of cabin cruiser-type boats – motoryachts, convertibles, express cruisers, cruising sailboats and cats, and the like — tell the long-term story of the fallout of the American 10% luxury tax. For boats larger than 40’ (12.19 m) in the categories above, below is the sales data based on U.S. registrations and documented boats for 2021 —

What Happened to the Trigger Man?

In late May 1994, federal charges were brought against Rostenkowski. The 17 counts included: keeping "ghost" employees on his payroll (paying salaries at taxpayer expense for no-show "jobs"); using Congressional funds to buy gifts such as chairs and ashtrays for friends; diverting taxpayer funds to pay for vehicles used for personal transportation; tampering with a Grand Jury witness; and trading in officially purchased stamps for cash at the House Post Office.

Six months later “Rosty” was defeated in his19th run for re-election by a 31-year old who was largely unknown. Even Rostenkowski’s Chicago district had had enough.

He served 17 months in federal prison and died in 2010.

But, the American cruiser business he shot was largely already dead.