How Much will the Canadian 10% Luxury Tax Actually Raise?

In late March the Canadian government, led by Prime Minister Justin Trudeau, announced that it was proceeding with a 10% luxury tax on boats sold in Canada valued at more than CAD $250,000. If this sounds like déjà vu all over again, you are right. At least five countries — including the U.S. — have tried luxury taxes on boats in recent history and all have repealed them because they killed thousands of jobs and actually netted less tax money.

Cutting to the chase: Historically, the rich resist being soaked. Since no one needs a boat except a drowning man, the wealthy buy other things or purchase stocks.

BoatTEST has gone to the trouble to examine the actual sales in Canada of new boats over CAD$250,000. We’ll tell you how much the Canadian government would raise in luxury taxes on boats even if the COVID-19 boat-buying frenzy continued and the rich defied the laws of human nature and decided to let themselves be soaked.

Déjà Vu

The Canadian luxury tax would be applied to cars and personal aircraft that retail at more than $100,000 and boats for personal use that retail above $250,000. The tax will begin to be collected on Sept. 1, 2022. The Canadian budget document estimates this measure will boost federal revenues by $604 million over five years, starting in the 2021-2022 fiscal year.

The government press release said, “Even as Canadians have sacrificed to keep our economy going through the pandemic, some of the wealthiest have done well. Those who can afford to buy luxury goods can afford to pay a bit more. To that end, the government is following through on its commitment to introduce a tax on select luxury goods.”

The tax is calculated at the lesser of:

- 20 per cent of the value above threshold ($100,000 for cars and “personal aircraft”; $250,000 for boats) or

- 10 per cent of the full value of the luxury car, boat or “personal aircraft.”

This formula means that all boats costing $500,000 or more will be taxed at 10%.

Adding Insult to Injury

We should add that this 10% luxury tax is on top of the 13% HST (Harmonized Sales Tax) that citizens of Ontario and several other provinces pay on new boats and most operating expenses. That means that a total of 23% in tax will be imposed for most Canadians buying a boat costing more than $500,000.

That means tax on boats adds up fast: $115,000 on a $500,000 boat; $230,000 on a $1 million vessel; and $1,150,000 on a $5 million motoryacht.

But the 10% luxury tax cuts two ways: If it kills sales, as it surely will, the provincial and federal governments together will lose the 13% HST — or $65,000, $130,000 and $650,000, respectively, in the examples above.

The Canadian public has been given until April 11, 2022, to provide “input’ to the government.

Our Input for Trudeau — The Actual Numbers

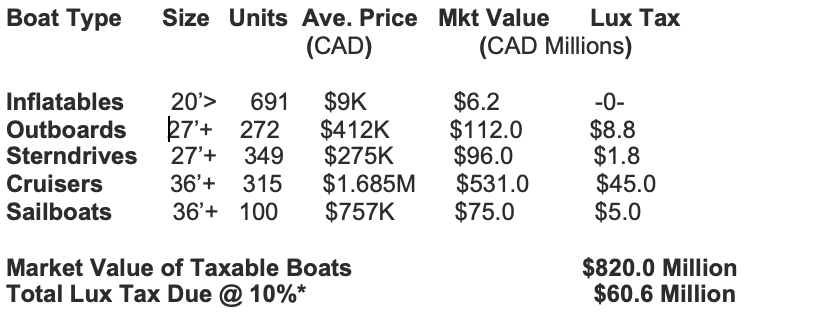

According to Canadian NMMA figures, based on a survey it conducted in July of 2021, a total of about 598 boats would be subject to the tax, had it been in effect the last 12 months. Our investigations confirmed that number, as indicated by the data below.

We hasten to point out that virtually all of those 596 boats are in the 30’ to 45’ (9.14 m – 13.71 m) range and are not megayachts. The number of boats over 65’ (19.81 m) built in Canada for recreational use each year can literally be counted on one hand – that’s right, five or less.

Based on the average price paid by Canadian buyers, as reported by the Canadian NMMA, of inboard cruisers in 2020, BoatTEST calculates that about CAD$60 million would have been collected in luxury tax that year – if buyers had defied the laws of nature.

Here’s How the Canadian Market Breaks Down by Boat Type and Size —

In addition to the $60.6 million in lux tax, there is another HST tax of 13% on these boats or CAD$106 million that would theoretically be collected.

The Canadian Government Tax Guesstimate

That revenue, of course, might occur if sales remain as they were before the lux tax. The Canadian government has published that it expects CAD$50 million in luxury tax will be collected – evidently factoring in a 17% drop in sales due to the tax.

This is an interesting percentage – as it is almost the exact inverse to what actually happened in the U.S. in 1991 when it tried a 10% luxury tax – only about 17% of the boats normally sold were purchased with the tax.

No Boats to Tax

Ironically, most Canadian boat dealers, of which there are about 20 in Ontario alone, that sell boats over CAD$250k have not ordered many – if any – boats from foreign builders that would be taxed the lux 10%. The reason is that they must buy those boats first out of their own pocket or with “floor-plan” loans from financial institutions that they are obligated to pay if the boats go unsold.

Being good business people, they are simply not ordering the boats because their customers have said they won’t buy them. So, the prospects are good that instead of collecting an added CAD$50 million, it will actually lose something on the order of CAD$100 million in HST taxes.

The American Luxury Tax Debacle

The U.S. Government Accounting Office (GAO) reported the amount of 10% luxury tax collected on boats selling for more than $100,000. The luxury tax had collected $168 million in total from boats, fur coats, jewelry, planes and cars. Most of these revenues were raised on car sales ($151.5 million) with only $7.3 million realized from the sales of boats.

On July 16, 1993, two and a half years after the 10% luxury tax went into effect, the Washington Post reported that the tax on boats had raised $12,655,000 for the U.S. Treasury, or according to the Post, “...enough to run the Department of Agriculture for a little over two hours.”

Then, there was the matter of the cost of the unemployment benefits paid out to say nothing of the loss of taxes from the unemployed. The government clearly lost millions of dollars that could have been avoided.

It’s a “Jobs” Issue Mr. Trudeau

By the end of the second year of the tax to “soak the rich” in the U.S., 50,000 blue and white-collar workers had lost their jobs – according to an NMMA spokesman. They were no longer paying taxes but were largely collecting unemployment.

According to the Canadian NMMA, there are 40,000 people in the marine trades in Canada. If just 2,000 marine workers in Canada are laid off, and they make the average income of all Canadians, which is CAD$68,250, about $22 million in tax normally collected from them would not be collected.

Compounding that loss of tax revenue is that those workers will then be drawing unemployment payments from the government. In Canada, the basic rate for calculating unemployment benefits is 55% of their salary, with the maximum being CAD$638 per week. The numbers quickly add up and they will immediately swamp any meager lux tax revenue that comes in.

Ms. Freeland – Have You Done Your Homework?

Trudeau’s Finance Minister is Chrystia Freeland. A recent issue of the leading Canadian newspaper, the Globe and Mail, quoted a speech Ms. Freeland gave the year before when talking about the proposed tax saying it was a “matter of fairness.”

In reference to boat owners paying the lux tax, she said, “...thank you for contributing a little bit of that good fortune to help heal the wounds of Covid…”

Thirty-one years ago, Congressman Dan Rostenkowski, the Chairman of the U.S. Congress’ House Ways and Means Committee, said nearly the same thing about the 10% luxury tax he rammed through Congress: “There was a concern that the rich pay their fair share. That is why Congress... increased the tax on big boats, luxury cars and expensive jewelry.”

For Rostenkowski, the luxury tax was a great phrase to put in a stump political speech to the very people he was going to be putting out of work. If he really wanted to “soak the rich,” why not just raise the marginal tax rate on high-income earners?

Two years later, after 50,000 marine workers we laid off, the true liberals of his own party led the move to repeal the luxury tax. They had seen enough and no longer feared Rosty who got caught with his hand in the till and was under indictment. Unfortunately, the damage was done and the American boat industry never recovered.

Either Ms. Freeland has not done her homework, in which case she should not be the country’s Finance Minister, or she has and still wishes to repeat the lie that the Trudeau government is perpetrating in order to perpetuate her career.

Duplicity Defined

The Oxford dictionary defines “duplicity” as: “Dishonest behavior that is intended to make someone believe something that is not true.”

That gets us back to where we started: Trudeau and Rostenkowski have political duplicity in common. They are not stupid people and they know full well what will happen — the trouble is that they think that most citizens are too stupid to get it.

* Methodology: Gross sales less $250,000 per unit sold in each boat type x 10%.