KVH Industries Posts Strong Third Quarter Sales

Total revenues for KVH Industries (KVHI), Inc increased by 5 percent compared to the same period in 2020. The company acknowledged that its Inertial navigation product sales are being impacted by supply chain issues but were able to overcome and deliver a solid quarter for shareholders.

Press Release from KVHI Nov. 4, 2021

KVH Industries, Inc., (Nasdaq: KVHI), in Middletown, R.I., reported financial results for the quarter ended September 30, 2021.

Third Quarter 2021 Highlights

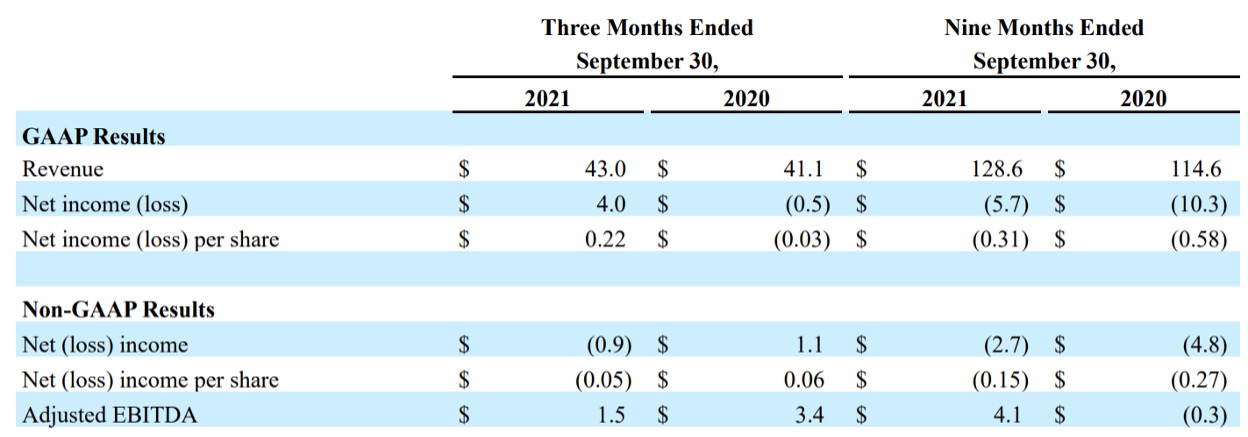

- Total revenues increased by 5% in the third quarter of 2021 to $43.0 million from $41.1 million in the third quarter of 2020.

- Revenues for AgilePlans, our Connectivity as a Service program for the commercial maritime sector, were up more than 54% compared to the third quarter of 2020. AgilePlans now represent 47% of our mini-VSAT Broadband subscriber base.

- Our mini-VSAT Broadband airtime revenue increased $2.9 million, to $24.6 million, or 13%, in the third quarter of 2021 compared to the third quarter of 2020, driven primarily by a 12% increase in active subscribers. Unit shipments were up 53% compared to the third quarter of 2020.

- Inertial navigation product sales, which were impacted by supply chain issues, were down $1 million, or 11%, to $8.4 million in the third quarter of 2021 compared to $9.4 million in the third quarter of 2020.

- Net income in the third quarter of 2021 was $4.0 million, or $0.22 per share, compared to a net loss of $0.5 million, or $0.03 per share, in the third quarter of 2020. Net income in the third quarter of 2021 reflects other income of $7.0 million resulting from the forgiveness of all principal and interest for the loan we received in May 2020 under the U.S. Small Business Administration’s Paycheck Protection Program.

- Non-GAAP net loss in the third quarter of 2021 was $0.9 million, or $0.05 per share, compared to a non-GAAP net income of $1.1 million, or $0.06 per share, in the third quarter of 2020.

- Non-GAAP adjusted EBITDA in the third quarter of 2021 was $1.5 million, compared to $3.4 million in the third quarter of 2020.

Commenting on the quarter, Martin Kits van Heyningen, KVH’s chief executive officer, said, “KVH recorded another strong quarter, reflecting our success in implementing our strategic priorities. Our VSAT product line set a record for units shipped in the third quarter of any year, driven largely by new AgilePlans subscriptions and our successful TracPhone V30 launch. Airtime revenue, a function of prior shipments, continued to grow at double-digit rates over last year, and gross margin remained stable as we added network capacity for our expanding mini-VSAT Broadband HTS subscriber base. On the cost side, we are working hard to transition the remaining of our legacy VSAT airtime subscribers to our HTS network as we prepare to exit our legacy network by year-end. This transition to an all-HTS network is important for maintaining the growth rate of our mini-VSAT Broadband service sales in 2022. In the inertial navigation segment, we are very excited about some recent design wins in the kvh.com 2 autonomous trucking market with our photonic chip-based IMUs. Hardware shipments in the quarter were impacted by supply chain issues which pushed some booked orders into Q4.”

“With respect to our outlook for the full year, we maintain our view that our full year revenues will increase by high single digits over 2020 revenue, and that our adjusted EBITDA will grow at a faster rate than revenue for the full year.”

Net Sales up for Mobile Connectivity, Inertial Navigation

The company operates in two segments, mobile connectivity and inertial navigation. In the third quarter of 2021, net sales for the mobile connectivity segment increased by $3.0 million compared to the third quarter of 2020. mini-VSAT Broadband airtime revenue increased by $2.9 million and content service sales increased by $0.3 million. This increase was partially offset by a $0.4 million decrease in mobile connectivity product sales. In the third quarter of 2021, net sales for our inertial navigation segment decreased by $1.1 million, or 12%, compared to the third quarter of 2020 partially due to supply chain issues. Inertial navigation sales decreased primarily due to a $0.6 million decrease in TACNAV product sales, a $0.5 million decrease in FOG and OEM product sales and a $0.2 million decrease in contracted engineering revenue.

Third Quarter Financial Summary

Revenue was $43.0 million for the third quarter of 2021, an increase of 5% compared to $41.1 million in the third quarter of 2020.

Product revenues for the third quarter of 2021 were $15.2 million, a decrease of 8% compared to the prior year quarter due to a $1.0 million decrease in inertial navigation product sales and a $0.4 million decrease in mobile connectivity product sales. Inertial navigation product sales decreased primarily as a result of a $0.6 million decrease in TACNAV product sales and a $0.5 million decrease in FOG and OEM product sales. The decrease in mobile connectivity product sales was primarily due to a $0.5 million decrease in TracPhone product sales. The decrease in TracPhone product sales was due to product mix, as the sales of high-end 1-meter antennas declined while sales of 37 cm antennas more than doubled.

Service revenues for the third quarter of 2021 were $27.7 million, an increase of $3.3 million compared to the prior year quarter primarily due to a $3.4 million increase in mobile connectivity service sales, partially offset by a $0.1 million decrease in inertial navigation service sales. Mobile connectivity service sales increased primarily due to a $2.9 million increase in our mini-VSAT Broadband service sales, which resulted in part from a 12% increase in active subscribers, primarily as a result of AgilePlans. Inertial navigation service sales decreased primarily due to lower contract engineering service revenue.

Our operating expenses increased $2.1 million to $18.4 million for the third quarter of 2021 compared to $16.3 million for the third quarter of 2020. This increase resulted primarily from a $1.0 million increase in salaries and employee benefits (primarily kvh.com 3 due to restoration of COVID-19 salary cuts), a $0.6 million decrease in funded engineering expenses, a $0.4 million increase in professional fees and a $0.2 million increase in bad debt expense, partially offset by a $0.3 million decrease in warranty expense.