MasterCraft Boat Holdings Posts Record First Quarter Results

MasterCraft Boat Holdings continues a slew of boat manufacturers posting strong financial earnings. The fiscal 2022 first quarter, which ended Oct. 2021, was the most profitable in the company’s history with record boat sales. For the past four quarters, MasterCraft has posted record sales results and plans to repurchase its own stock, according to the company.

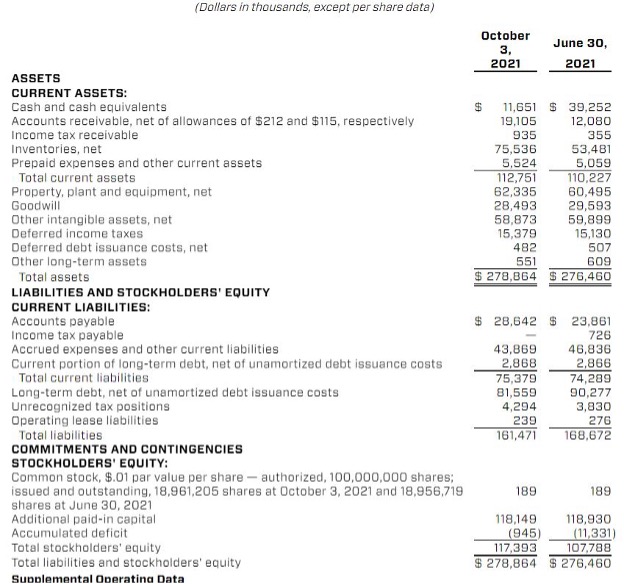

MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT), based in Vonore, Tenn., recently announced financial results for its fiscal 2022 first quarter ended October 3, 2021.

First Quarter Highlights

For three quarters in a row, MasterCraft Boat has had record sales and once again delivered the most profitable first quarter in the Company’s history, with record unit sales, net sales, net income, and adjusted EBITDA.

Among the notable highlights:

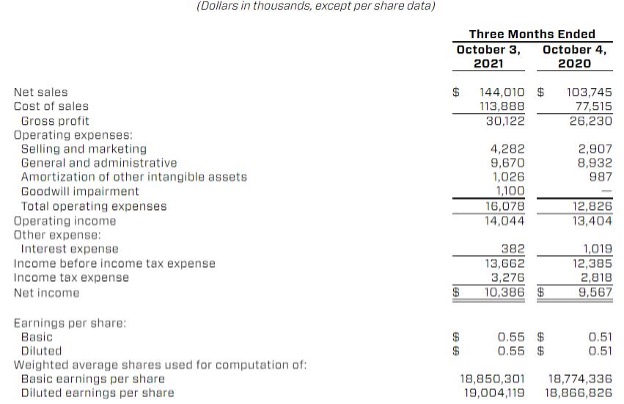

- Net sales for the first quarter increased to $144.0 million, up 38.8%.

- Net income was $10.4 million or $0.55 per diluted share.

- Diluted Adjusted Net Income per share, a non-GAAP measure, was $0.67, up 15.5%.

- Adjusted EBITDA, a non-GAAP measure, increased to $19.4 million, up 14.3%.

- Initiated purchasing under the $50 million share repurchase program.

CEO Looks to Build on Success

Fred Brightbill, Chief Executive Officer and Chairman for MasterCraft Boat Holdings reflect on how the quarter went for the boat builder.

“Our business performed extremely well during the first quarter in a very challenging and dynamic environment. These results reflect a continuation of exceptional execution against our strategic and operational priorities as we delivered a record-setting performance for the fourth consecutive quarter. Net sales, diluted adjusted earnings per share, and adjusted EBITDA were all the highest for any first quarter in the Company’s history,” Brightbill said.

“Despite many challenges, we had a solid start to fiscal 2022. We achieved industry-leading organic growth, and we will look to build on that success during the remainder of the year. Guided by our consumer-centric strategy and facilitated by our best-in-class operating model, recent third-party industry data confirms we have outperformed many of our top competitors to take meaningful market share.”

First Quarter Results

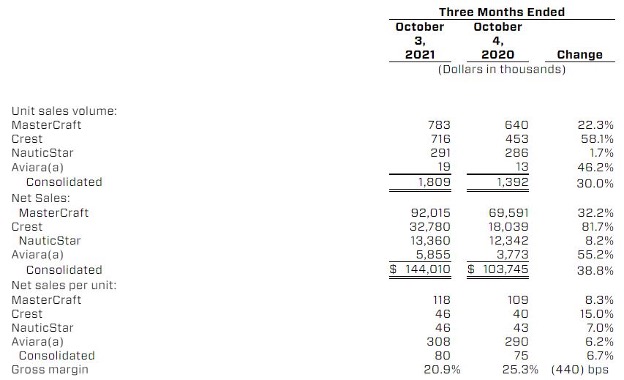

For the first quarter of 2022, MasterCraft Boat Holdings, Inc. reported consolidated net sales of $144 million, up $40.3 million from the first quarter of 2021. The increase was primarily due to increased volumes. Higher prices, favorable model mix, and higher option sales also contributed to higher net sales.

Gross margin declined 440 basis points to 20.9 percent in first quarter 2022 from 25.3 percent in first quarter 2021. Higher revenues yielded a lower margin due to supply chain disruptions and inflationary pressures that drove materials and labor costs higher. In addition, we incurred incremental overhead costs associated with the Merritt Island, Florida facility acquired in second quarter of fiscal 2021.

Operating expenses were $16.1 million for the first quarter, up $3.3 million from the prior-year period. Selling and marketing expenses increased due to the timing of prior year expenses being impacted by the COVID-19 pandemic, resulting in lower costs for the first quarter of fiscal 2021. General and administrative expense increased as we continued to make investments in research and development and information technology.

Net income was $10.4 million for the first quarter, compared to $9.6 million in the prior-year period. Diluted net income per share was $0.55, compared to $0.51 for the first quarter 2021. Adjusted Net Income increased to $12.8 million for the first quarter, or $0.67 per diluted share, compared to $10.9 million, or $0.58 per diluted share, in the prior-year period.

Adjusted EBITDA was $19.4 million for the first quarter, compared to $17.0 million in the prior year period. Adjusted EBITDA margin was 13.5 percent for the first quarter, down from 16.3 percent for the prior-year period, due to increased costs.

See “Non-GAAP Measures” below for a reconciliation of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, and Adjusted Net Income per share to the most directly comparable financial measures presented in accordance with GAAP.

Outlook

For full-year fiscal 2022, consolidated net sales growth is expected to be up in the 20 percent range, with Adjusted EBITDA margins in the 18 percent range, and Adjusted Earnings per share growth up in the 25 percent range year-over-year. This guidance represents another record year based on the organic growth potential of our brands. Driven by growth-oriented projects, we now expect capital expenditures to be in the $25 million range for the full year.

For the second quarter of fiscal 2022, consolidated net sales growth is expected to be up in the 30 percent range, with Adjusted EBITDA margins in the 14.5 percent range, and Adjusted Earnings per share growth up in the 5 percent range year-over-year.

“We remain committed to making investments to further strengthen our competitive position, grow our brands, and deliver shareholder value guided by our long-term focus and strategic priorities,” Brightbill said. “Looking forward, we are raising our guidance for the full year on the strength of our operating performance and wholesale visibility.”