Record Profitability, Backlog for Sanlorenzo

Italian luxury yacht builder Sanlorenzo (SL.MI) reported a banner quarter with record profitability and backlogs at a record high for the company. The company went public in Dec. 2019 for €16 on the Italian Stock Exchange in Milan and was quoted at over €38 at mid-day last Friday. The Superyacht Division (one of three) paved the way with sales up more than 33 percent compared to 2020. Order backlog is reported to be more than €1.2Billion.

Press Release from Sanlorenzo; Nov. 4, 2021

Sanlorenzo S.P.A.’s Board of Directors approved the periodic financial information as of September 30, 2021. The company had excellent results with net revenues from the sale of new yachts at €428.4 million (+32.8%) and new record profitability with EBITDA at €68.6 million (+41.5%). The record backlog at €1.2 BILLION as the company confirmed its 2021 guidance.

- Net revenues from the sale of new yachts (“Net Revenues New Yachts”) at €428.4 million, up by 32.8% on the first nine months of 2020, led by the outstanding performance in the Americas and Europe

- Adjusted EBITDA at €68.6 million, up by 41.5% on the first nine months of 2020, margin of 16.0% on Net Revenues New Yachts, up by 100 basis points

- EBIT at €52.1 million, up by 57.4% on the first nine months of 2020, margin of 12.2% on Net Revenues New Yachts

- Group net profit at €36.8 million, up by 64.9% on the first nine months of 2020, margin of 8.6% on Net Revenues New Yachts, up by 170 basis points

- Investments at €36.7 million, of which €24.7 million in the third quarter, more than doubled compared to the first nine months of 2020, as a result of the acquisition of new industrial facilities

- Net cash position of €35.2 million, a strong improvement on a net debt position of €5.1 million as of 30 September 2020 and a net cash position of €3.8 million as of 31 December 2020

- Order intake in the third quarter of €381.1 million, leading the backlog to reach €1.2 billion, with a significant increase of the amount related to next years

- Guidance, envisaging a double-digit growth of the main metrics in 2021, confirmed

The Board of Directors of Sanlorenzo S.p.A. (“Sanlorenzo” or the “Company”), which met today under the chairmanship of Mr. Massimo Perotti, examined and approved the periodic financial information as of 30 September 2021.

Massimo Perotti, Chairman and Chief Executive Officer of the Company

“The results we approve today testify to the soundness of Sanlorenzo’s business model and the ability to navigate with constancy, commitment and resolution towards our medium-long term goals. Our compass is a growth that, if I firstly defined gentle, now I consider “meaningful”. Such an excellent sales performance is also achieved by keeping on launching new models at a constant pace, as we did this year: most recently at the Fort Lauderdale boat show, after the world 2 premieres in Cannes, we unveiled the new asymmetric model of Sanlorenzo family, SL106A, in addition to the American debut of the SL96A and BGX70. Following the international boat shows, we have orders amounting to €1.2 billion into the pipeline, with three new ranges already planned for 2022.

Together with product results, we pay strong attention to economic performance and sustainability: the growth in EBITDA and in the main financial indicators achieved in the nine months of the year provides us significant visibility on future growth, confirming Sanlorenzo as luxury Maison in the yachting sector.”

Consolidated Net Revenues New Yachts

Net Revenues New Yachts1 in the first nine months of 2021 were equal to €428.4 million, of which €164.8 million was generated in the third quarter, up by 32.8% compared to €322.6 million in the same period of 2020.

In a context of strong market acceleration, this performance is a result of both a rise in volumes due to the high collection of new orders and an increase in average selling prices, specifically for superyachts, made possible by the high-end positioning of the brand, with a product mix that has an increased incidence of larger yachts in all divisions.

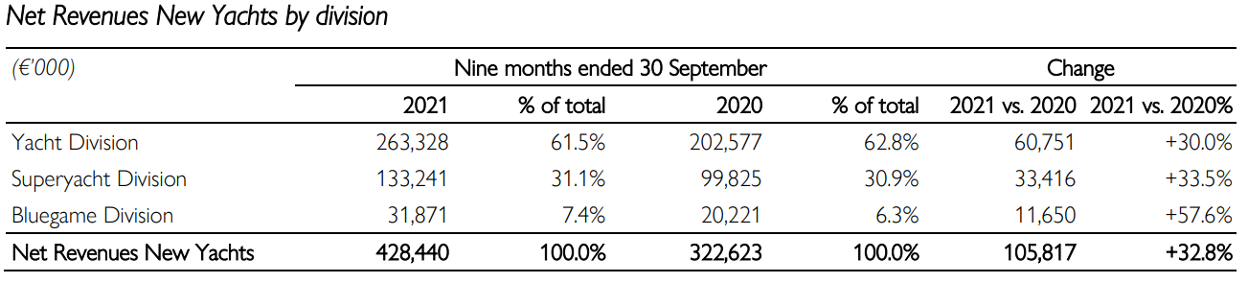

Net Revenues New Yachts by Division

The Yacht Division generated Net Revenues New Yachts of €263.3 million, accounting for 61.5% of the total, up by 30.0% on the first nine months of 2020. The excellent sales performance concerned all product ranges, and in particular the SX line (with the SX112 model introduced in 2020), the SD line (with the new SD118 model presented at the Cannes Yachting Festival) and the SL line (with the asymmetrical models).

The Superyacht Division generated Net Revenues New Yachts of €133.2 million, accounting for 31.1% of the total, up by 33.5% on the first nine months of 2020, driven by the Steel Line and the new X-Space Line, which was extremely well received even before its launch, expected in 2022.

The Bluegame Division generated Net Revenues New Yachts of €31.9 million, accounting for 7.4% of the total, up by 57.6% on the first nine months of 2020, thanks in particular to the results of the BGX line, with the introduction of the second model BGX60, launched in 2020, and the first sales of the new BG72 model, recently presented at the Cannes Yachting Festival.

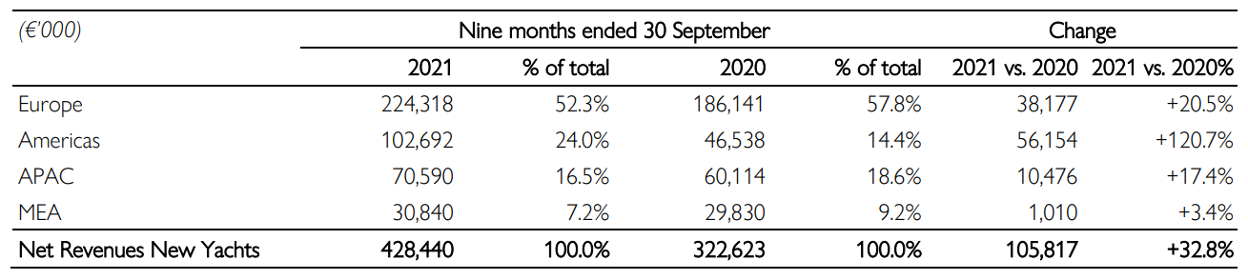

Net Revenues New Yachts by Geographical Area

Europe recorded Net Revenues New Yachts equal to €224.3 million (of which €44.2 million generated in Italy), accounting for 52.3% of the total, up by 20.5% on the first nine months of 2020.

The Americas recorded Net Revenues New Yachts equal to €102.7 million, accounting for 24.0% of the total, up by 120.7% on the first nine months of 2020, with excellent results in the United States.

The APAC area recorded Net Revenues New Yachts equal to €70.6 million, accounting for 16.5% of the total, up by 17.4% on the first nine months of 2020, driven by sales in Hong Kong.

The MEA area recorded Net Revenues New Yachts equal to €30.8 million, accounting for 7.2% of the total, a slight increase compared to the first nine months of 2020.

Consolidated Operating and Net Results

Adjusted EBITDA2 was equal to €68.6 million, up by 41.5% compared to €48.5 million in the first nine months of 2020. The margin on Net Revenues New Yachts was equal to 16.0%, up by 100 basis points on the same period of 2020.

EBITDA3, including non-recurring components linked to the non-monetary costs of the 2020 Stock Option Plan and the expenses incurred for COVID-19, amounted to €67.9 million, up by 43.3% compared to €47.4 million in the first nine months of 2020.

The significant and constant increase in operating profits is related to the efficiencies generated by the optimisation of the new production capacity and the resultant greater absorption of fixed costs. Profitability also benefited from the shift in product mix towards larger yachts in all divisions and from the increase in average selling prices, which offset the increase in raw material costs.

EBIT was equal to €52.1 million, up by 57.4% compared to €33.1 million in the first nine months of 2020. The margin on Net Revenues New Yachts increased to 12.2% from 10.3% in 2020, in spite of an increase of 10.6% in depreciation, which stood at €15.8 million, as a result of the coming on stream of investments made to develop new products and to increase production capacity.

The pre-tax profit was equal to €51.3 million, up by 62.5% compared to €31.6 million in the first nine months of 2020.

Group net profit reached €36.8 million, up by 64.9% compared to €22.3 million in the first nine months of 2020. The margin on Net Revenues New Yachts was 8.6%, up by 170 basis points from 6.9% in 2020.

Consolidated Balance Sheet and Financial Results

Net working capital as of 30 September 2021 was negative for €(7.7) million, down by €26.9 million compared to €19.3 million as of 31 December and down by €35.3 million compared to €27.6 million as of 30 September 2020.

Inventories were equal to €68.1 million, down by €14.1 million compared to €82.2 million as of 31 December 2020 and down by €25.0 million compared to €93.2 million as of 30 September 2020. Inventories of finished products were equal to €26.8 million and included pre-owned boats already sold at the end of the period to be delivered in subsequent months, for a value of €8.1 million.

The performance of net working capital is consistent with the business seasonality, also in view of the concentration of yacht deliveries in the summer months, and positively influenced by the increase in backlog.

Investments amounted to €36.7 million, of which €24.7 million made during the third quarter, more than doubled compared to €17.3 million in the first nine months of 2020, including €21.9 million intended to increase in production capacity and €10.6 million for product development. In particular, during the third quarter, three acquisitions of industrial facilities located next to the Company’s shipyards of Viareggio, Massa and La Spezia were concluded, for a total consideration of €19.2 million (including transaction costs), which will result in a significant increase in production capacity to respond to an acceleration in sales.

Net financial position was positive and equal to €35.2 million (€3.8 million net cash as of 31 December 2020 and €5.1 million net debt as of 30 September 2020), with an improvement of €40.2 million on the previous year, mainly thanks to the strong cash generation from operating activities, despite significant investments.

Cash as of 30 September 2021 was equal to €139.1 million (€94.4 million as of 31 December 2020 and €100.9 million as of 30 September 2020). As of 30 September 2021, total available liquidity amounted to €270.9 million, including unused bank credit lines equal to €131.8 million.

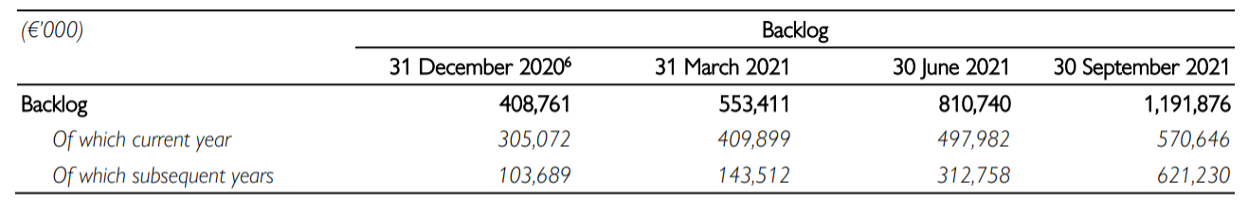

Backlog

Group backlog7 as of 30 September 2021 amounted to €1,191.9 million, up by 521.7 million compared to the figure as of 30 September 2020 (€670.2 million) and up by €783.1 million compared to the figure as of 31 December 2020 (€408.8 million). The order intake in the first nine months of 2021 was equal to €783.1 million, of which €381.1 million in the third quarter.

During the third quarter, the increase in the order portfolio was led by the extraordinary performance of the Superyacht Division and by the extremely positive feedback received following the three boat shows that were held in September (Cannes Yachting Festival, Genoa Boat Show and Monaco Yacht Show), which have seen the start of numerous commercial negotiations, partially already closed with the signing of sales contracts, regarding in particular the recently launched products (SL90 Asymmetric, SL120 Asymmetric, SD118 for the Yacht Division and BG72 for Bluegame) and the new X-Space range of the Superyacht Division which will be presented in 2022.

The amount of the gross backlog for the current year, equal to €570.6 million, covers the 2021 guidance related to Net Revenues New Yachts. The visibility on revenues of subsequent years is also significant and amounted to €621.2 million, fostered by an increased incidence of larger yachts in all divisions, with delivery dates until 2024. The backlog solidity is confirmed thanks to a coverage by final clients of about 91%.

Business Outlook and Guidance

The strong growth dynamics of the yachting sector are being consolidated over the months, fostered, in the luxury segment, by the expansion of potential customers belonging to the Ultra High Net Worth Individuals, which are constantly increasing in terms of both number and wealth, particularly in the United States and APAC.

In this context, Sanlorenzo continues to benefit from the unique characteristics of its business model: high-end positioning of the brand, yachts always at the forefront of innovation, rigorously made-to-measure with a sartorial approach for a club of selected customers, close liaison with art and design, distribution through a limited number of brand representatives, flexible cost structure.

The expected growth, partly already reflected in the backlog as of 30 September 2021, is fostered by a robust product pipeline, envisaging the launch in 2022 of three new ranges – SP (“Smart Performance”), X-Space and BGM (Bluegame Multi-hull) with which Sanlorenzo tap into new market segments, characterized by novel functions and strongly inspired by sustainability criteria. These are the principles that also guide Research and Development, focused today in particular on diesel electric yachts and marine application of fuel cells, activity that will receive a strong acceleration thanks to the strategic agreement with Siemens Energy.

In parallel, the Group is enhancing the offer of the High-End Services Division, established in 2020, entirely focused on the proposal of a package of services, to which only Sanlorenzo clients will have access, including tailor-made leasing and financing, the first monobrand charter fleet (Sanlorenzo Charter Fleet), maintenance, refit and restyling services (Sanlorenzo Timeless) and crew training at the Sanlorenzo Academy.

The Group also continues to carry on the programme to constantly increase operating profit margins, fostered by the efficiencies generated by the optimisation of new production capacity, in further expansion thanks to the investments made in the third quarter, and the increase in the prices of new orders.

In light of all of the above, also by virtue of a backlog for the year 2021 equal to €570.6 million, the Company confirms the guidance8 for the current year which envisages a double-digit growth of the main metrics.