Why Fuel Prices Will Come Down

The 42% rise in fuel prices during the last six months did not occur because

Chinese car sales are up 18% this year. Rather there has been a confluence of factors

that have spiked fuel prices almost straight up, and many analysts feel they can

be expected to drop back into the low $3 range next spring, if not sooner. Oil traders

say that one of the reasons oil prices shot skyward this spring is that China began

bulking up on oil to make sure they had plenty for this summer's Olympic Games.

We have been through this high fuel price hysteria in the U.S. before, and guess

what has always happened in the past? Just as Congress is beginning to think about

thinking about an energy policy, fuel prices come down just in time for GM bring

to bring out a new high-margin gas guzzler to save its bacon. Things are different

this time, you say? Indeed they are. As reported on the front page of Monday's New

York Times, many nations -- in fact over half the world -- are subsidizing the price

of fuel.

|

From the New York Times, 7-28-08 --

From Mexico to India to China, governments fearful of inflation and street protests

are heavily subsidizing energy prices, particularly for diesel fuel. But the subsidies

— estimated at $40 billion this year in China alone — are also removing much of

the incentive to conserve fuel.

Subsidies Responsible for Increased

Oil Use

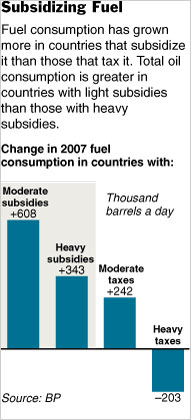

The oil company BP, known for thorough statistical analysis of energy markets,

estimates that countries with subsidies accounted for 96 percent of the world’s

increase in oil use last year — growth that has helped drive prices to record levels.

In most countries that do not subsidize fuel, high prices have caused oil demand

to stagnate or fall, as economic theory says they should. But in countries with

subsidies, demand is still rising steeply, threatening to outstrip the growth in

global supplies.

The Pendulum Swing

Indeed, the biggest question hanging over global oil markets these days may be how

much longer countries can keep paying the high cost of subsidizing their consumers.

If enough countries start passing the true cost of oil through to their citizens,

many economists believe, demand growth will slow, bringing the oil market into better

balance and lowering prices — although the long-term economic rise of China and

other populous countries makes it unlikely that gasoline prices will plunge back

to the levels of several years ago.

China raised gasoline and diesel prices on June 21, though still keeping them below

world levels. World oil prices plunged more than $4 a barrel within minutes on the

expectation that Chinese demand would slow.

In Indonesia, the government spends six times as much on energy subsidies as it

does on agricultural investments, even as rice prices have skyrocketed this year.

Many countries, like India, have raised oil prices considerably in recent months,

only to watch world prices climb even further, pushing up the cost of subsidies

once again. China’s estimated $40 billion in subsidies this year is up from $22

billion last year, mainly for this reason, although consumption has also risen,

with Chinese buying 18 percent more cars in the first half of this year than in

the period a year earlier.

In Countries without Exxon

Political pressures and inflation concerns continue to prevent many countries —

particularly in Asia, where inflation has become an acute problem — from ending

subsidies and letting domestic prices bounce up and down.

“You talk about subsidies, you’re not only talking about the economy, you’re talking

about politics,” said Purnomo Yusgiantoro, Indonesia’s minister of energy and mineral

resources. He ruled out further price increases this year beyond one in May that

raised the price of diesel and regular gasoline to $2.30 a gallon.

Indonesia spends more on fuel subsidies, $20 billion this year, than any country

except China. Some economists estimate that fuel use in Indonesia would fall by

as much as a fifth if the government were to eliminate subsidies entirely.

Before adjusting the prices, Malaysia was spending 7.5 percent of its entire economic

output on fuel subsidies, a greater share than any other nation. Indonesia follows

with 4 percent.

Coming elections in Indonesia and India make further subsidy reductions less likely

in both countries. And big oil exporters like Saudi Arabia have so much revenue

right now that they can easily afford to subsidize fast-growing domestic demand.

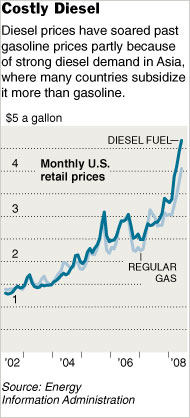

Diesel Subsidies Raise U.S. Prices

In Asia, subsidies have been particularly prevalent for diesel, although many countries

subsidize gasoline as well. The subsidies have been an important reason diesel prices

have climbed almost twice as quickly as gasoline prices have over the last year

in the United States.

Many governments see diesel as more important because truckers and ship captains

need it to distribute goods; if diesel prices rise, consumer prices often follow.

Diesel is essentially the same fuel as heating oil, so high diesel prices mean high

prices for heating oil. Spiraling prices already have some in the Northeast United

States worried about how families will afford to heat their homes this winter.

To be sure, subsidies are not the only cause of high crude oil prices. Strong global

economic growth, particularly in Asia, is requiring a lot of energy. Political tensions

between the United States and Iran and market psychology have played a role.

The good old days in China and India are gone.

But how long can the world subsidize oil?