New State Boat Taxes Could Kill an Industry

New York’s Governor Paterson has proposed

a 5% tax on new boat sales in December and we’re concerned that not only New York

might implement it, but that other states may copycat the idea. Already a bill has

been introduced into the Illinois state legislature and been swatted down just as

fast because it was an obvious job killer. In 1991 to 1993 over 500,000 people lost

their jobs in the marine industry thanks to the 10% boat tax, and many boat builders

and dealers went out of business. Congress repealed this mis-guided, job-killing

tax in 1993, but much of the industry never recovered. Will your state be the next

one to consider a boat tax?

|

|

Congressman Dan Rostenkowski nearly murdered the boating industry in 1991 with his 10% luxury tax on new boats. He was later convicted of a felony and served (not enough) jail time. |

As every boat owner knows, no one “needs” a boat except

a drowning man. So, if the government places an additional tax on boat sales it

not only raises the cost of a boat, but it is also deemed punitive and unfair by

potential boat buyers. As proved by the Federal “Luxury Tax” debacle in 1991-93,

the public will simply not buy boats and will spend its money on something without

an onerous tax.

The result of such a sales tax in New York will be that boats will not be sold,

therefore boats won’t be built and workers will be laid off. One doesn’t need a

PhD. in economics to see this simple cause and effect. New York represents significant

boat sales and given everything else going on in the economy, this could well be

the last straw for an industry grabbing at straws to survive.

Bailing out States Not Boats…

In New York State, Gov. Paterson said in December, 2008, that he would propose legislation

that would impose an additional 5% tax on cars priced over $60,000, boats over $200,000,

jewelry and furs over $20,000 and non-commercial aircraft over $500,000.

Two months later Illinois State Rep. LaShawn Ford (who must have found an old copy

of the New York Times) introduced Illinois HB 451 that was a virtual copy of Paterson's

scheme. Thankfully, folks in Illinois had long memories and the national boating

association (NMMA) which is headquartered in Chicago, jumped all over the state

legislature showing them the job-killing nature of such a tax. It died quickly.

|

|

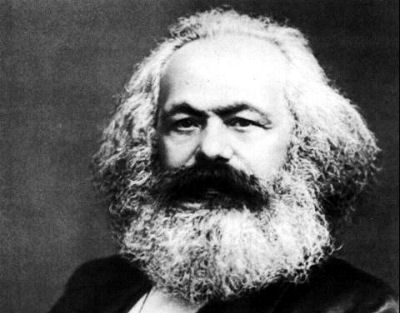

If only Karl had understood the dynamics of boat building he could have redistributed wealth a far better way. |

Redistribution of the Wealth…

In our opinion boating is the best redistribution of the wealth program ever invented.

Just think about: People happily pay thousands, even millions, of dollars to have

boats built by hundreds of workers. With that boat, they then have the privilege

of operating and maintaining it which employees even more people.

Money goes from the so-called “rich” to workers at the boat companies and at all

of the factories that make all of the components going into the boat. To us this

sounds like job creation and redistribution of capital into the hands of people

who will spend it.

Boat Taxes Don't Work

Boat taxes don’t raise money. The small amount of tax raised by what few boats

might be sold is more than soaked up by tax collection costs and the unemployment

claims paid out to displaced marine workers. Again, the 1991-93 federal tax on boats

raised only chump change.

Boat taxes are supposed to penalize the “rich” for enjoying a luxury. But “rich”

people are smarter than the people who write the boat tax legislation – they avoid

the tax by not buying a boat. They buy something else which is not taxed, or just

save the money. In the meantime working people in the boat business lose their jobs.

|

|

Rostenkowski was chairman of the House Ways and Means Committee and in 1990 and insisted on the 10% luxury tax on boats even though he knew it would be a job killer. |

They’d Never Do it Again…

You think so? The fact is that in 1990 Rep. Dan Rostenkowski, who was writing the

tax bill, knew that a 10% luxury tax on boats would kill tens of thousands of jobs

in the marine industry, yet he did it anyway. Why? Simply because it made a good

stump speech sound bite of “soaking the rich” and provided camouflage for the real

intent of the bill which was to help prop up Detroit in its losing battle against

$30,000+ automobile imports. Rosty made an unholy bargain with Detroit to trade

marine worker jobs for auto worker jobs.

(FYI--In 1996, Rostenkowski pleaded guilty to charges of mail fraud. He was fined

and was sentenced to 17 months in prison, of which he served 15.)

Hey, it Doesn’t Affect Me…

If you don’t live in New York, it is easy to think that it is not “your problem.”

Unfortunately, it is your problem for a number of reasons. First, is the copycat

syndrome where the small states copy what the “big” states do. Second, lower boat

sales in big states means that boat prices have to rise to cover boat builders fixed

costs. Thirdly, the industry is so precarious these days it will not take much to

push some builders over the edge. Fewer builders mean fewer choices, less competition,

and ultimately higher prices down the road.

One way or another every boat owner will be affected if New York enacts an additional

tax on boat sales.

What You

Can Do…

This newsletter goes to 165,000 people each week. Many of those readers (that means

YOU) know state legislators, governors, editors, and other people that can affect

a legislative outcome. If any of them even think about a boat sales tax, hit them

over the head with a (virtual) 2 x 4. You can start with Governor Paterson.

Please send us your comments and suggestions…