How the Recession Is Changing Boat Building

There has been much in the news about

what is happening in Detroit, in housing, on Wall Street, and elsewhere – but what

exactly is the current recession doing to the industry that builds the boats that

we love? Everyone knows that sales are down, but what exactly is going on among

the companies that dream up, design and build our boats? Will some positive changes

come out of this economic trauma?

|

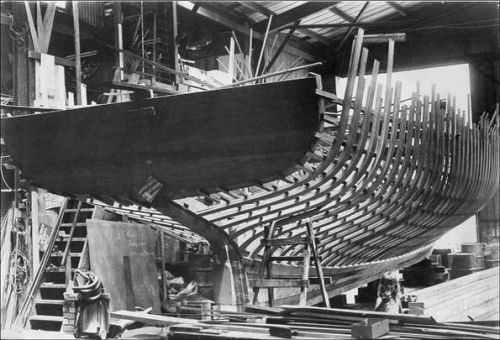

| Boat building the old fashioned way – one at a time. |

Not surprisingly, boat building has been hit harder than virtually any other industry

in America. As in virtually all economic downturns it is the first to take the economic

hit, and the current trouble is no exception. Here are some of the changes we see sweeping across the boat building companies…

1. Company Presidents are Getting Hands-On. Most company presidents

will now take phone calls from customers. While some presidents always did this

(usually among family-owned enterprises), now the practice is fairly widespread.

If you are seriously in the market for a new boat and a company president won’t

take your call, you may have learned all you need to know about his brand. (We are

firm believers that corporate culture – and attitude -- starts at the top and rolls

down hill.)

2. Naysayers are Disappearing. Just as in many industries, middle

management and lower levels of top management at most boat companies have thinned

considerably or are gone altogether. One result has been that there are fewer people

to say no to customer requests and there is faster response time to many questions

and requests. At the same time what management is left will generally work hard

to overcome impediments to a sale, whether that be helping to find financing, making

a building change order, or in some other way eliminating objections or problems

involved with a sale or customer service.

3. Engineering and Design Staffs Sharply Reduced. This sounds like a bad thing, but it probably is not for the consumer in the short run. Historically, the boating industry has had very small engineering staffs and much of the work

was farmed out. During good times staffs naturally grow, but now they are back to

square one. Likewise other infrastructure support staffs have been cut to the bone.

4. Where’s the Fat? With white and blue collar staffs cut to the

bone, U.S. boat building is as efficient and as low-cost now as we have ever seen

it. Take a look at the nation’s boating magazines and you will note that this year

they have turned into little more than pamphlets. Boat show glitz, fancy brochures,

in-house sales magazines, new generations of ever more complicated websites have

all been put on hold. These days “overhead” means little more than keeping the lights

on “overhead.” When a company president now says he needs to get a certain price

for a boat, he isn’t kidding. He will not risk losing a sale for some extra

margin.

5. A New Way of Building – the Old Way. Building boats for stock

has been virtually eliminated at most companies. Factory workers have been laid

off until only skeleton crews are left. That means consumers may not be able to

walk in to a dealership and find exactly the boat they wanted in the current model

year, or get it shipped from the factory the next day. Builders want consumers to

buy non-current stock at dealerships, so they can get back to planned production

when business improves.

If you have very specific ideas as to how you want your new boat equipped for this

summer, you had better order now, because chances are your boat will be special

ordered.

Many boat companies are manufacturing only one week a month, or are closed until

May. Some are building only when they have several orders accumulated and others are building continuously but with a staff significantly smaller than before, and

are therefore producing only a few units each week.

6. Hibernation in a Bear Market. Many builders are going into one

form or another of “hibernation.” That is to say, many are experiencing a “sales

winter” so they are conserving their resources and staying alive. When the sun once

again comes out they will be able to wake up and ramp up production. The fact that

you may find that a factory has shut its doors does not mean it is out of business

– it could be in hibernation. We do not expect many companies to go out of business.

The fact is that over the last four years business has been getting more difficult

each year, and most of the weakest builders have already bitten the dust.

7. Boat Prices are Being Reset. At least four things are happening

at the same time: consumers are able to buy new boats at lower prices than last

year because everyone is discounting, overhead expense has been sharply cut back,

and raw material costs have been dropping because of the global downturn. Consumers

are trending to down-sizing both the boat and the equipment and frills going into

the boat and are looking for lower operating costs. Builders are reexamining what

they are putting into their base pricing and many brands will likely build in less

in the future.

During the last 40 years the boating industry has survived fuel shortages, 20% interest

rates, a 10% luxury tax, and other calamities and each time has come back with a

bounce. We expect the same will occur this time around, but certainly things will

be different.