Inflation --How It Can Help You!

We are all well aware of boat and automobile depreciation. But what many boaters are not aware of is what happens to used boat prices when there is rampant inflation. Americans haven’t seen that in over 25 years, but many people are saying that it could be just around the corner. If so, people who buy yachts in the 50’ to 80’ range today, and maybe smaller sizes, too, could see the boats depreciate over five or ten years a very small amount, if anything at all.

A number of well-maintained, low-hour 70’ Hatteras motoryachts bought in the early to mid 1970s, because of inflation, sold 10 years later for nearly what the owner paid. |

It happened a long time ago, but that doesn’t mean it can’t happen again. Indeed, as the 2008 world-wide financial meltdown proved, things that “can’t happen now” because of new whatever, can happen again. The U.S. government’s “guns and butter” policies of the mid-1960s of fighting the Vietnam War and spending on creating the “Great Society” came home to roost in the U.S. in terms of inflation in the late 1960s and throughout out the 1970s. For over a decade 10%-15% inflation became a way of life for Americans. People bought assets because to wait was only to insure that they couldn’t be afforded later.

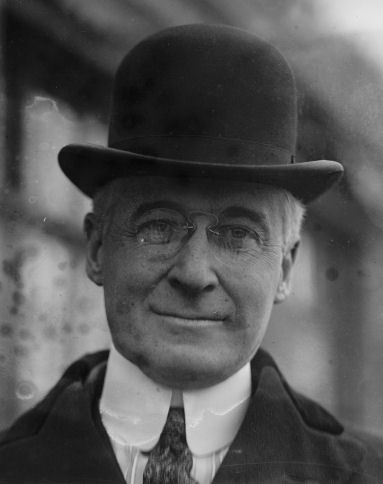

Bernard Baruch – “Never follow a crowd.” |

Nothing any administration tried seemed to work. Indeed, President Nixon even tried price and wage controls to no avail. Finally in the late 1970s President Carter hired Paul Volker to be Fed Chairman and his job was to stop inflation – and he did! He did it by raising interest rates to double digits. When interest rates started hitting 20%, the country was thrown into a recession, but inflation dropped to reasonable numbers.

Perfect Storm for the Consumer

How do you break even on owning a large boat? Most people will tell you that such a statement is an oxymoron, and we would be inclined to agree – except we have seen it done under certain circumstances in certain types of boats. Will American economic history repeat itself? We say, why not?

We think there could be a confluence of major factors occurring in just the right order to make “buying now and selling in 5 to 10 years” an exercise in minimum depreciation of a large motoryacht – those from 50’ to 80’, and maybe on boats larger and smaller

as well. Here’s how it might work--

1. Most new motoryachts in the 50’ to 80’ range have sold for a fairly constant price the last three years due to the Great Recession. Builders have seen their

margins shrink as they held or lowered prices just to keep people employed and have some

cash flow.

2. By all accounts, boat prices will be going up in the next year or two because of the increase in materials and lower production over which to amortize fixed overhead.

Builders are done subsidizing new boat construction.

3. Baby boomers begin hitting 65 this year and will be looking to buy their “dream boat” – the one they have always wanted to buy – and it is now or never. The baby boom demographic will continue hitting age 65 for the next 9 years or so before the numbers of people hitting that age begins to ease off.

4. Virtually all economists – even people such as Nobel Prize Winner Paul Klugman – say that the U.S. will experience a period of higher inflation once we come out of the Great Recession. (The highly respected Klugman says let’s worry about inflation later, but for now lets spend ourselves out of the recession.)

As new boat prices go up, used boat prices get sucked up right under them, staying a respectful distance lower, of course. With inflation pushing prices up 5% to 10% a year it doesn’t take long before a boat’s used boat value could be nearly what was paid for it in the first place.

It Has Happened Before

It was this scenario that took place for people buying boats in the 50’ to 70’ range in the mid 1970s and then sold in the mid 1980s. Bernard Baruch called it the “miracle of compounding,” and it works for inflation just as it does for investing in fixed-return investments. With 5% annual inflation, the cost of a new boat could grow 63% over 10 years. At 7% annual inflation, it could grow 96% over 10 years.

In this scenario, a boater who buys right can have his cake and at the end of the day eat most of it, too. Stranger things have happened.

(As they say, past performance is no guarantee of it happening again in the future.)