Boat Pricing May Be Readjusting (Slightly) Downward

For many dealerships an over-stocked showroom is a thing of the past.

It is no secret that the best selling boats are the ones at the lower end of the price scale. Most of these boats have been marketed as "value-oriented," which means ones that are priced below their competitors with comparable equipment. This year they seem to have been gaining market share at the expense of brands further up the food chain. As a result, brands that are typically thought of as the most expensive in type are among those where we are seeing some price re-adjustment.

Evolution in Pricing

When BoatTEST.com did a series of interviews with veteran boat builders several years ago we asked why boats had gotten so expensive. The uniform answer was that, in addition to the rise in commodity prices, the amount of equipment and amenities expected to be on a boat to make it competitive in the market place had grown tremendously. For example, Leon Slikkers, founder of Tiara and Pursuit, said that there was no comparison between boats built in the 1980s vs. those built the 2000s. "There is so much more in the boats these days it is unfair to compare their pricing," he said.

Paul Allen's superyacht Octopus is probably the most loaded boat on the planet and is an exaggerated version of what went on all through the boating ranks the last two decades. She is loaded with tenders, subs, choppers, fishing boats, sportboats, PWCs and nearly anything else Allen could think of.

His sentiments were echoed by other industry veterans. In fact over the last couple of decades there has been, for lack of a better phrase, "amenity creep." In the same period there has also been a vast improvement in boat quality, raw building materials, and building methods among most boat builders. Some of this was brought about by the NMMA certification requirement that boats be built to a selection of ABYC standards, but much of it was brought about by competition and a change in consumer attitudes. Increasingly boaters wanted the best -- and the most -- money could buy. It all evolved slowly and because of the robust economic times and new buyers entering the market, sales numbers didn't indicate massive price resistance.

Load Her Up, Harry

In the go-go years of the mid-1990s and early 2000s, boat buyers wanted boats loaded with all of the latest electric gadgets such as flat-screen TVs and high-end stereo equipment. Accessory manufacturers were constantly coming out with new, exciting toys to go on boats such as underwater lights, chartplotters, gps, sophisticated engine monitoring systems, powered seats and windows, wine coolers and many other items.

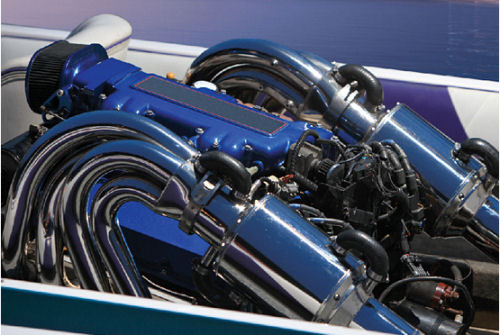

Air conditioning, Type II toilets, watermakers, radar, sat TV and communications all added extra cost. Ever-increasing horsepower demands made engine options proliferate -- and always at the expensive end. People buying new boats wanted all of the bells and whistles and the boating industry was happy to oblige.

And the need for speed kept growing throughout this period, although it was slowed from time to time by spikes in fuel prices. The result was larger and larger outboard engines, and larger inboard diesel engines.

Owned by Russian billionaire Andrey Melnichenko, "Giga yacht A" cost about 150 million Euros at the Blohm & Voss shipyard, Germany. She looks a lot like a submarine, measures 387 feet, with 3 pools, 1 master suite, 6 guest suites, and rooms for 42 staff. To give you a better idea of scale, the fuel tank on this thing apparently costs $1.4 million USD to fill up.

The New Rich Boater

Also during the last two decades a new breed of boater got into the market with hot money and a dearth of boating experience. These people usually came in at the big end, buying the most expensive, or the flashiest boat they could afford. This influx of new money had the greatest impact in the large motoryacht category where the number of slim models in mini-skirts standing around the boat seemed to be more important to buyers than how many bilge pumps the boat had. (Predictably, when the financial going got tough in 2008 many of these people lost their interest in boating.)

For these buyers, cost was no object. The only thing that counted was plenty of gadgets to show off to their smaller-boat owning friends and a great place to have lunch on the aft deck facing the quayside wannabes. This phenomenon played itself out for nearly 20 years, from bass boats to megayachts.

Prices up 122% In Some Cases

To illustrate this point, just look at what happened to the average price of inboard cruisers from 36' to 40' from 2000 to 2009, as published by the NMMA: In 2000 the average price for boats in that size range was $221,732. By 2009 it had grown to $492,006 -- an increase of $270,283 or 122%!

Using the same time period, inboard cruisers from 31' to 35' increased in price 92%, going from $137,730 to $265,053 in 2009. Sterndrive-powered boats 24' and over increased 78% in the same time period to an average price of $42,667. As a benchmark, outboard-powered boats from 19' to 20'11" increased in price from $12,470 in 2000 to $20,313 in 2009, an increase of 63%.

According to Measuringworth.com the purchasing power of the U.S. dollar in the U.S. declined 25% from 2000 to 2009 -- an average of 2.8% per year. For the same period boat prices increased from 7% a year on average for the outboard boats cited above, to 13.5% a year, average, for the 36' to 40' inboard cruisers.

(What did Bernard Baruch say about the miracle of compounding?)

Has there been a sea change in the consumers' appetite for boats? Sometimes we wonder what is going on.

A Sea-Changed Consumer

But all of that changed after Lehman Brothers hit the fan and the world economy nearly melted down in September of 2008. The lead article in the November issue of Soundings Trade Only quoted William H. McGill, president and CEO of Marine Max, the world's largest boat retail organization, as saying, "...the consumer has changed -- and I guarantee you the consumer has changed in the last two years -- everyone is more sensitive about the money they're spending."

McGill is quoted as giving the example of a 40' boat with four flat screen TVs as standard equipment. He said that 20 years ago a 28' boat didn't have air conditioning and now many have it, as well as a generator to power them. McGill said, "So we have to look at how customers are boating and say,' Why complicate things if you don't need to.' "

The article quotes Thom Dammrich, president of the NMMA (National Marine Manufacturers Association) as saying, "We've got to build what the market wants and right now that means smaller boats."

Indeed, the Soundings Trade Only article states that Tiara "...and its dealers have chopped about $160,000 from the retail price [of the Sovran 3500], offering the boat with Volvo Penta IPS400 diesels for $399,000, company officials say."

Staff reductions have been drastic in the boating industry.

Lower Overhead

Over the last three years the infrastructure of nearly all boat builders has been drastically reduced. White collar office staffs have been slashed to bare-bones. Most companies are operating with skeleton crews in support departments such as purchasing, marketing, customer service, design and engineering. Even sales staffs have been greatly reduced, and in many cases middle management no longer exists.

Reduced Capital Investment

Not surprisingly new model introductions have slowed, or been drawn out, further reducing cash demands. Builders no longer carry large or even moderate inventories, thus reducing financing charges and corporate debt. Factories that were added to meet demand of the go-go years have been sold, and along with them fleets of trucks and other equipment no longer needed.

New fiberglass boat tooling is expensive and labor intensive. All-new products have been few.

Marketing budgets have been drastically curtailed by virtually all boat builders. Boating magazine advertising has dropped to 20% of what it was just a few years ago. Some boat brands have not been advertised in print for over 18 months as builders rely on the Internet and their dealer network to get the word out about their boats. Even boat show expenditures have been greatly reduced or in some cases nearly eliminated.

The result of all of this -- and much more -- is that corporate general and administrative costs have been greatly reduced and variable expenses have shrunk. The combination of fewer items of standard equipment, smaller engines, and lower overhead is finding its way into boat pricing for many brands.

All Not Rosy

All of this is in the face of other forces that are raising the cost of manufacturing. For example, the EPA's requirement that all inboard and sterndrive gasoline engines have catalytic converters is adding $3000 to $6000 per engine to the cost of boat building. (This may be one of the factors contributing to the increased number of outboard-powered runabout models in the lower size ranges.)

The catalytic converters on a boat's engine will cost anywhere from $3000 to $6000.

Resin prices have been marching upward for the last two years irrespective of oil prices and the global recession. Looming in the future is the amalgamation of ABYC design and building requirements with those of the European Union so that there can be one worldwide set of standards for boat building, which will undoubtedly raise building costs somewhat.

Dealer Margin Holding Firm

What we are not seeing, and what consumers cannot expect, is a reduction in dealer margin on boat sales. Those days are pretty much over as most non-current product has been sold off over the last three years. Both dealers and builders are now being careful to keep field inventory in line with demand. Dealers know that they have to hold their margin on sales to stay in business.

Industry sources tell us that over 1,400 boat dealers went out of business over the last three years, and certainly the way that the industry is conducting sales and marketing is changing in many respects. There is a trend to regional showrooms and showrooms at the factory. Far less inventory is actually on a dealer's premises (or on his floor plan balance sheet).

Low or No Inventory

Some builders are not requiring dealers to inventory the larger boats in their lines and will pay a flat fee to the dealers to take the orders, commission the boats, and service the customer. Some builders are selling direct in one fashion or another. Usually this has the effect of reducing the price of the boat.

If you get to a dealer's showroom and he has no inventory, don't be surprised. It is the new paradigm. He will still gladly take your order and chances are the boat will cost you less as a result.

Tight credit has resulted in the reduction of floor plan inventory and those interest expenses for many dealers. Customers for some brands no longer have the convenience of driving down to their local dealership and seeing the exact model desired, but on the other hand the boat when ordered will not have margin built in to cover floor plan interest for an undetermined number of months. That savings may well be passed along.

Caveat

Consumers used to wheeling and dealing with cash-starved dealers the last three years should be prepared for most dealers to hang tough on pricing.

Every boat builder is in a different situation so there can be no hard and fast rules about pricing. That is why we say we see lower prices "here and there." Depending on the size, type, where the boat is built, and the company's pricing strategy before the Great Recession, prices might in fact be higher. Clearly an operation that was lean in 2007 which built a no-frills boat and which has had to absorb increases in resin and engine prices like everyone else, will not be in a position to lower prices much, if at all.

Boats leaving Ft. Lauderdale on their way to Europe for delivery to happy owners taking advantage of the weak U.S. dollar.

Brands that have been building "value" boats all along are not the brands getting in step with the new buyer -- they were ahead of the curve and were courting him for years.

Some builders of large boats or imported boats will probably be raising prices because of low unit production and the weak U.S. dollar. On the other hand, boat buyers outside the U.S. can reap the benefit of both the weak U.S. dollar and any G&A cost reductions that are passed along. In fact, the last few months BoatTEST.com has noticed a sharp increase in overseas buyers for American product.