Register Your Boat Offshore

Yacht Registration

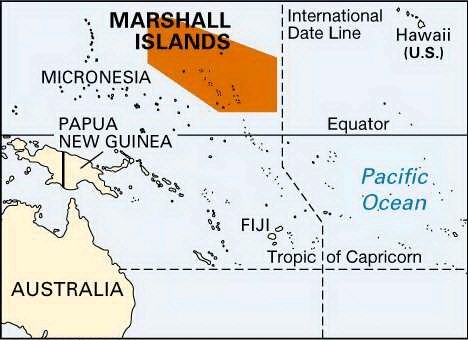

Most boaters must register their vessels with the states in which they reside or use their boat. Larger boats are usually documented with the USCG, and still larger motoryachts have typically registered “offshore.” Talk to your accountant and lawyer to see if there are any advantages for you. The big news is that the Marshall Islands will now register boats down to 39’ (12 m).

There are many yacht registry services in the world and there are seven or eight countries that traditionally have been havens for offshore registration. Islands in the Marshall group were used for U.S. nuclear testing from 1947 to 1962, and while it is an independent country, increasingly Americans have been using it for yacht registrations.

Following is an explanation of the major advantages of offshore registration which we found on the Yacht Registration Center’s website--

Written by YRC on January 8, 2018. Posted in Articles

It can be reasonably argued that apart from the decision on what type of yacht to buy, a yacht owner has one other very important decision to make; which flag to have her registered under. Choosing a flag is not an easy task as many considerations need to be made, i.e. the flag requirements, annual taxes, reputation of flag etc. What is extremely important at the end of the day is the ownership structure of the yacht, meaning whether the yacht will be registered directly in the name of the physical person – yacht owner or in the name of a new corporate entity which is formed for such purpose. In fact, nowadays the trend seems to be for the yacht to be owned by a corporation, for various reasons.

One of the main and most common reasons for using a corporate entity as owner of a yacht is privacy. Reasonably, many yacht owners want to keep their ownership confidential without having their name appearing on any public official document. This can be avoided by registering the yacht in the name of a corporate entity where in fact the yacht is being used privately by the principal of the said entity. In this way, the anonymity and privacy of the beneficial owner is maintained.

In addition, a primary motive for the creation of a corporate structure is the fundamental legal principle of the corporate world: limited liability. By forming a limited liability company, the yacht owner can minimize their personal liability and protect their personal assets by keeping them untouched and safe. What is meant by that is that the risk to the shareholders is limited to the assets of the corporation, i.e. the value of the yacht. If the corporation’s liabilities due to any claims against the yacht itself exceed the assets of the corporation, the corporation would simply be dissolved without having the personal assets of the shareholders taken to satisfy the claim. If the yacht was instead owned directly by an individual owner, any uninsured loss caused by the yacht would become a personal liability of the owner, having their entire net worth exposed to such claims.

Another important factor to be taken into consideration in deciding to form a new entity to hold the yacht is the ease of disposition of the yacht. The sale of the yacht might become easier by transferring the shares from the holding company to the buyer, especially if maintaining the existing flag. Instead of selling the yacht to another party, the company itself is sold, with the yacht being the sole asset of such company. Often such sale may be exempted from sales taxes.

In addition, the qualification for a flag is a determining consideration in yacht registration and ownership. As a matter of fact, all of the flags have different ownership requirements and consequently many individual owners may not be allowed to have their yachts directly registered in their name in the flag of their choice. This difficulty is avoided through the incorporation of a corporation of a jurisdiction which qualifies for a flag, which would otherwise not be available to the individual owner.

Last but not least, the intended area of cruising, which often relates to the tax consequences, is also a determining factor for the ownership structure of the yacht. Anyone who intends to use a private yacht within EU waters must be aware of the VAT consequences since all private yachts owned or used by EU residents (including EU corporations/entities) must have their VAT paid in order for the boat to be used in EU territorial waters. On the other hand, any private yacht which is owned and used by a non –EU resident (under a non EU flag, etc.) may be allowed to enter EU waters for up to 18 months on a Temporary Import basis free of VAT implications.