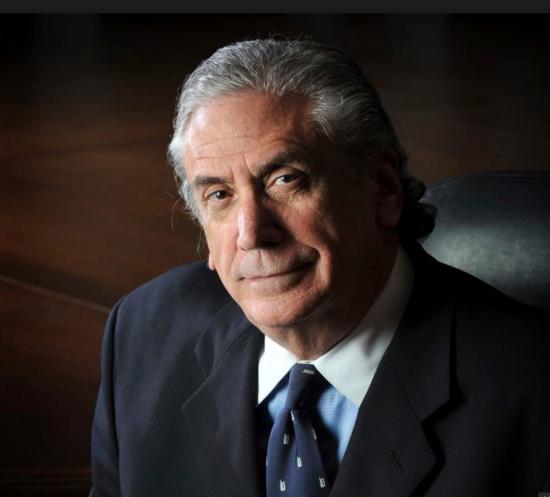

Irwin L. Jacobs Dies: Major U.S. Boat Builder for 40 Years

It was announced on Wednesday that Irwin L. Jacobs, 77, and his wife, Alexandra, of 57 years, died at their home outside Minneapolis, MN. He had a lifelong love of fishing and boats that drove him to not only buy numerous boat companies but also to take an active interest in running them. Jacobs also started the FLW tournament series and many related businesses that promoted fishing and boating.

It All Started with Larson Boat Company

Jacobs was a self-made man who started in his father’s junk business, in what was literally a rag to riches story, at one time he made the Forbes 400 richest people in America list. Jacobs often said that his love of boats and fishing started out when he was a young lad working with his father collecting scrap metal, and their relaxation at the end of the day was fishing.

After some early business successes in his early 30s, in 1977 Jacobs bought the Larson Boat company for its bank debt just before foreclosure. In interviews he explained that he lost $5 million with the company before he finally turned it around five years later, making it in the 1990s and early 2000s, one of the top 10 ten builders in the highly-competitive sportboat market.

Just recently Larson, which he owned along with his partner, John Paul Deloria, was sold to Polaris Boats in Syracuse, IN. Striper, FX, and Escape brands were also part of the deal.

Irv the Liquidator

Jacobs’ first opportunistic purchase was of the Grain Belt brewery in northeast Minneapolis in 1975. Though he never brewed any beer, he made a small fortune on the company.

Jacobs borrowed about $4.5 million from banker Carl Pohlad to finance the Grain Belt acquisition, then sold off the assets in three steps. First, deciding that a small, local brewer could not compete cost-wise with industry giants, he sold the Grain Belt brand to G. Heileman Brewing (based in LaCrosse, Wisconsin, at the time) and recovered most of his initial investment. Next to go was the brewery equipment, sold over a two- to three-year period. Finally, the real estate assets were sold to the City of Minneapolis in the early 1980s for $5 million, which is the amount he netted.

Next, when W.T Grant went bankrupt, he bought $32 million in receivables. By delaying the closing on the purchase for 35 days, but making collections in the meantime, Jacobs was able to nearly pay the asking price at closing time. He said that within 75 days he was well in the black on the transaction.

Master of “Greenmail”

Over the years, his deals and liquidations became much bigger and more lucrative, and they catapulted Jacobs to the top rank of such celebrated buccaneers as T. Boone Pickens, Carl Icahn, and Saul Steinberg. Jacobs tried to acquire Kaiser Steel, Walt Disney Productions, and Avco Corp., losing them all and making, with his associates, over $90 million. The theme of these exertions seemed to be “how to succeed by failing—or, how to make a fortune through thwarted takeovers.”

Genmar Grows

In 1984, Jacob’s Genmar Corp. bought Wellcraft, which at the time was one of the largest boat builders in the U.S. It built boats from small center consoles and entry-level boats to 40’ flybridge vessels. Perhaps its most famous boat at the time was the 36’ Scarab high-performance boat featured in the popular TV series Miami Vice. This was a huge purchase, but Jacobs was not done.

He Bought AMF to Get Hatteras

In 1985, Jacobs decided that he wanted to buy Hatteras Yachts, America’s premier builder of large motoryachts. At the time, Hatteras was owned by AMF, a NYSE-traded conglomerate that owned bowling allies, Head Skis, and many other lucrative businesses. Jacobs enjoyed telling the story of how the AMF CEO, Tom York, would not take his calls about buying Hatteras, so he simply bought AMF for $550 million.

After the acquisition, Jacobs’ first item of business was to fire York for using the corporate jet to ferry his kids around the country, in addition to not taking his phone call. Within six months, Jacobs had recovered $540 million in the sale of 60% of the company’s assets, but not Hatteras.

Hatteras, like all American boat builders, was devastated by the U.S. Congress-passing the 10% luxury tax in 1990, but Jacobs hung in with the company through its darkest hours. Then, in 2001, after the market recovered somewhat, he sold it to Brunswick for $80 million in cash.

Bankruptcy, the Mother of Opportunity

In 2000, the Outboard Marine Corporation (OMC), maker of Evinrude and Johnson outboard engines, filed for Chapter 11 protection. During the 1990s, OMC got caught up in the “transom” buying frenzy engaged in by Mercury, and to a far lesser degree by Yamaha. The idea was to buy boat companies that built outboard boats simply to be able to put their brand’s engines on the transom, and in that way not have to engage in the marketing of its products to the consumers. If consumers bought the boat brand, they would get the owner’s engines whether the buyer wanted them or not.

OMC owned Chris-Craft, Hydra-Sports, Four Winns, PrinceCraft, Lowe, and Javelin. Virtually all of these companies were sold at robust prices in the 1990s, so OMC had considerable debt. Bumps in the economy, plus the advent of 4-stroke engines introduced by Yamaha, and quickly followed by Mercury which used a private-label Japanese 4-stroke outboard, made life tough for OMC. The fact that its management didn’t know boat building didn’t help, and when management was changed, more chaos was added to the mix.

OMC’s bankruptcy was made to order for Jacobs, who cherry-picked the brands he wanted. Bombardier bought the engine brands and its factories.

Genmar – Largest Privately Held Boat Company

By 2005, Jacob’s Genmar owned over a dozen boat lines and was the largest privately-held boat company in the United States. Besides Wellcraft, its largest division, Genmar owned Larson, Glastron, Lund, Lowe, Crestliner, Cajun, Excel, Aquasport, Carver, Trojan, Excel, Scarab, Champion, and Ranger.

Jacobs often said that Ranger was the most profitable boat brand he ever owned.

In 2007, he sold his aluminum fishing boat brands – Crestliner, Lowe, and Lund -- to Brunswick for a tidy profit. Six months later the bottom fell out of the aluminum boat market as banks began tightening up on second-mortgage credit requirements – a precursor of what was to come the following year.

Eye to Innovation

Because Jacobs took such an active roll in managing his boat companies, he was well aware of the challenges in the business. One of his objectives was to reduce the high cost of what is essentially a hand-built product through efficient mass production. To that end, he bought the process of making center console boats out of roto-molded polypropylene – and the boat brand Triumph emerged. In the early 2000s, one of the best boating video commercials ever made demonstrated how tough Triumph boats were.

The VEC hull molding process was another bet Jacobs made to lower the cost with mass boat building. He bought the patent on the process and then invaded in the expensive steel dies and hydraulic machinery that resin-infused fiberglass in a clamshell mold under tremendous pressure.

At one time Larson, FinCraft and Striper boats were made with this technology which could produce a cured hull within 35 minutes, instead of the eight hours it took for laying a hull up by hand and waiting for the cure.

Unfortunately, the great recession reduced sales numbers so low that the process was no longer viable.

What Goes Around, Comes Around

The financial crisis of September 2008 hit the boat business as hard as any sector of the American economy, and boat builders with large debt were vulnerable. Boat sales shrank to a trickle and the bank which Jacobs had relied on for so many years to finance some of his acquisitions called his loans, even though his payments were current. The result was that Genmar went into Chapter 11.

After a complicated restructuring of the assets of the boat companies, in February 2010, Platinum Equity bought most of Genmar brands for about $70 million in a court-supervised sale, and then turned around and sold Jacobs and his partner, DeJoria (known as J&D Holdings), the assets that were not central to its strategy. Jacobs declined to say how much he and his partner paid Platinum.

Platinum Equity said at the time that it would put its collection of boat brands “on a path toward long-term growth and profitability.” It followed the usual model of private equity firms, five years later selling Four Winns, Wellcraft, Scarab, and Glastron to the Beneteau Group, which was looking for a boat building facility at the time. They got the plants in Cadillac, MI, plus the four boat brands.

The bass boat brands Ranger, Stratos, and Triton were sold to Bass Pro Shops which put these brands in with its other, high successful boats.

J&D Holdings then moved ahead with six boat brands: Carver, FinCraft, Larson, Marquis, Seaswirl, and Triumph, and three factories that it purchased from Platinum. The company also bought one other asset: a boat-building technology called VEC that Jacobs saw as his key competitive advantage.

Recently, J&D holdings sold off Larson, SeaSwirl, FInCraft which has been rebranded, and Triumph. Last winter Marques became a custom brand, leaving only Carver in full production.

Boat Companies Owned By Jacobs

From 1977 until this week, Irwin Jacobs at one time owned at least 19 boat brands at one time or another, by our count. They include Larson, Ranger, Stratos, Lowe, Lund, Crestliner, Sea Swirl, PrinceCraft, Trojan, Hatteras, Carver, Marquis, Triumph, FX, Escape, Wellcraft, FinCraft, Four Winns, Scarab, Glastron, Triton, Champion, Windsor Craft, and others.

Over the years, tens of thousands of people all over the world have owned boats built by the companies that Irwin Jacobs owned. During our many interviews with him over the years, while he was clearly in business to make money, he also did not skimp on the hardware and equipment installed. “When it comes to building boats,” he once told us, “I don’t cheap out.”

Following is an excerpt from the Star-Tribune --

Prominent Twin Cities businessman Irwin Jacobs and his wife were found dead Wednesday in their Lake Minnetonka home in an apparent murder-suicide, according to a close friend and business associate.

Orono Police Chief Correy Farniok said officers who responded to the Shoreline Drive home shortly after 8:30 a.m. found the bodies in a bed along with a gun.

Jacobs for much of his career was a nationally known investor who looked for unrecognized value in companies and sometimes made huge profits with short-term stock trades. Alexandra Jacobs was an accomplished painter and a devoted mother and grandmother who avoided the limelight that her husband often relished.

“We are heartbroken by this loss, and we ask that our privacy be respected as we grieve during this very difficult time,” the couple’s children said in a statement, adding that they were shocked and devastated.

The Jacobs children declined further comment.

Dennis Mathisen, a longtime business associate of Irwin Jacobs, told the Star Tribune Wednesday afternoon that Irwin killed his wife and then himself. Both were 77.

Mathisen described himself as a “very dear friend” of Irwin Jacobs. He said Mark Jacobs, a son, and a secretary for Irwin Jacobs, told him of the deaths and that Irwin was responsible for them.

Mathisen said Alexandra Jacobs “had been in a wheelchair for the last year or so and had signs of dementia. Irwin was just distraught over her condition.”

He said he spoke with Irwin Jacobs about three days ago, and “he was upbeat. I talked with his son Mark yesterday, and he talked to both of them. He said Irwin seemed up.”

Keith Carpenter, vice president and general counsel for Hopkins-based Jacobs Management Corp., said late Wednesday afternoon that they were “dealing with a big loss.”